How to Rollover a 401(k) to a Self-Directed IRA in 2024

Estimated reading time: 8 minutes

The trend is clear — job switching is on the rise. From 2020 to 2022, 38% of Americans switched jobs. That’s up from 32% in 2018.

Unfortunately, nearly 40% of those who switched jobs drained their entire 401(k) balance upon leaving their employer. This can lead to a hefty tax bill, and if they’re below 59½, a 10% penalty. Worse yet, it means that many Americans aren’t capitalizing on tax-advantaged growth.

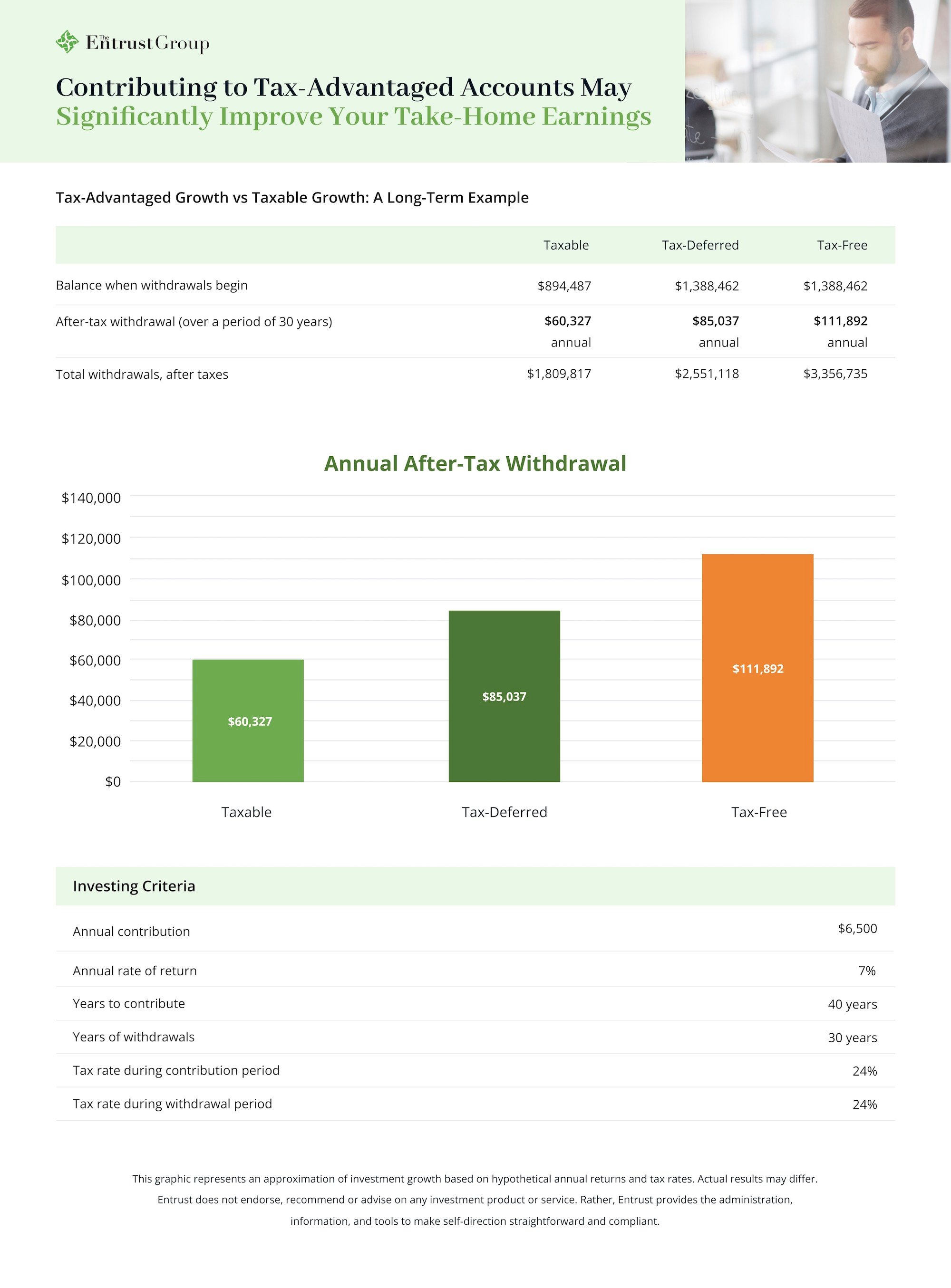

Whether you choose a tax-free or tax-deferred strategy, devoting more of your take-home pay to tax-advantaged accounts can make a significant impact. Down the line, it’s no exaggeration to say that it can save you hundreds of thousands of dollars.

Perhaps one of the reasons that so many drain their 401(k)s is that they feel disconnected from the assets in their portfolio. Long investment horizons and impersonal mutual funds leave little room for attachment.

Fortunately, there’s another option — a self-directed IRA (SDIRA).

With an SDIRA, investors are able to put their hard-earned savings toward assets they know and believe in. Think real estate, private equity, private lending, and more. Plus, rolling over funds from a former employer’s plan is quick and easy.

If you want to capitalize on the compounding benefits of tax-advantaged growth, learn how to roll over your existing retirement funds into an SDIRA.

The Benefits and Flexibility of an SDIRA

At a brokerage, your only IRA investment options are stocks, bonds, and mutual funds.

With an SDIRA, you can invest in any asset the IRS allows, including startups, condos, silver bullion, and countless more. This diversification potential allows you to spread risk over many different sectors. Plus, you can leverage your specialized expertise to spot hidden gems that others have overlooked.

If you’re a real estate guru, you can turn a fixer-upper into a hefty payday for your SDIRA. If you have an eagle eye for transformative startups, you may be able to 10x your initial nest egg. Or, if you simply want to invest in your community, you can funnel your savings into the new bakery down the street.

In essence, SDIRAs stand apart due to their flexibility. Self-directed investors are empowered to choose investments that align with their unique goals and risk tolerance.

For many, the first step to self-directed investing is rolling over the funds held in an existing retirement plan. Thousands of dollars wrapped up in a former employer’s 401(k) could be the springboard you need to get started.

And if you make the decision to switch, the rollover process may be simpler than you think.

How to Move Your 401k to a Self-Directed IRA

If the majority of your existing retirement funds are in the 401(k), 403(b), or governmental 457(b) of a former employer, you’ll need to initiate a rollover.

Keep in mind, most plan administrators don’t allow you to make penalty-free withdrawals as long as you have an active plan. In other words, if the majority of your funds are with your current employer, you may not be able to complete a rollover.

If this is the case, check with your current 401(k) administrator. Ask whether they allow in-service withdrawals. If they do, you may still be able to convert your 401(k) to a self-directed IRA.

To complete a rollover at Entrust, you’ll need to complete two simple steps:

- Provide a copy of your plan statement to Entrust

- Contact your 401(k) or other plan custodian to initiate the rollover

Providing a Copy of Your Statement

You can submit a copy of your plan statement to Entrust digitally or with paperwork. Here’s how to submit your statement through the Entrust Client Portal.

Providing a Copy of Your Statement through the Entrust Client Portal

- Open an SDIRA with Entrust.

- Once your account is active, go to the Entrust Client Portal. Navigate to the “Transactions” tab and click on “Fund Account.” Then, select “Rollover.”

- Fill out the online application and submit it.

- Attach a PDF file of a complete statement (no more than 6 months old) from your current custodian. It should contain:

- Your name (first and last)

- Custodian information (plan name, address, and phone number)

- Account number (if applicable)

- Type of account (401(k), 403(b), or governmental 457(b))

- A description and valuation of the assets being rolled over

That’s all there is to it. Now, if you’d prefer to submit your statement the old-fashioned way, that’s possible as well. The process is a bit more complicated, but we’ve broken it down step-by-step to walk you through it.

Providing a Copy of Your Statement with Paperwork

- Open an SDIRA with Entrust

- Download the Rollover Form.

- Confirm that you have a valid identification (ID) on file. If your account wasn't opened online, call our Client Services Department at 1-(800)-392-9653 to confirm your ID. Once you’re connected, select option/extension one.

- Attach a photocopy of a complete statement (no more than 6 months old) from your current custodian. It should contain:

- Your name (first and last)

- Custodian information (plan name, address, and phone number)

- Account number (if applicable)

- Type of account (401(k), 403(b), or governmental 457(b))

- A description and valuation of the assets being rolled over

- Submit the completed form and required documents to Entrust.

- If your former plan administrator requires a letter of acceptance, instruct the administrator to send their requests to transfers@theentrustgroup.com

- If there is any documentation that must be signed by Entrust, send to:

- Email: transfers@theentrustgroup.com

- Mail: The Entrust Group, 555 12th Street, Suite 900, Oakland, CA 94607

- Fax: Write “Attention Transfers” on the cover page and fax to (510) 587-0960

Whether you completed the process digitally or by hand, you’ve now completed ½ of your 401(k) rollover to an SDIRA.

Now, let’s explore the other phase of the process: contacting your current custodian and initiating the rollover.

Contacting Your Custodian and Initiating the Rollover

In order for us to complete the rollover, you’ll need to contact your current custodian and withdraw funds.

Now is the time to inform you that there are two ways to complete a 401(k) rollover: direct rollover and indirect rollover. We’ll cover both methods in this article.

In most cases, a direct rollover will be the simplest and safest approach. This way, you never take possession of the funds. They travel directly from your current custodian to Entrust, so tax withholding is not necessary.

If you choose this method, here’s an overview of the process:

Direct Rollover:

- Contact your custodian. Let them know that you need to withdraw funds from the account for a direct rollover. Follow the custodian’s standard withdrawal process.

- Instruct your administrator to make the check payable to The Entrust Group, Inc. FBO [Client Name] Account # [Entrust Acct. Number].

- Here’s an example: The Entrust Group, Inc. FBO John Smith Account #12345

- Mail the check(s) directly to the Entrust Group at:

- The Entrust Group, 555 12th Street, Suite 900, Oakland, CA 94607

- Once we have received your funds, you’ll receive a confirmation email. If you haven’t received confirmation from us within 7-10 days, contact your former custodian administrator for the status of the rollover.

Indirect Rollover:

A direct rollover is the easiest path for most, but you also have the option to initiate an indirect rollover.

This approach is riskier than a direct rollover, as you temporarily take possession of your retirement savings. It also means that a small percentage of the funds will be withheld. For a 401(k) withdrawal, 20% will be withheld. However, your account will retain this amount if you complete the rollover.

Once you’ve made the withdrawal, you have 60 days to deposit the funds in another tax-advantaged account like an SDIRA. If you miss the deadline, the funds will become taxable. This may leave you with a hefty tax bill, and if you’re under 59½, a 10% penalty.

60 days should be ample time to complete an indirect rollover. However, if you’re prone to procrastination, you may want to think twice before initiating this process.

If you make the decision to complete an indirect rollover, there are three steps you’ll need to complete the rollover.

- Contact your custodian. Let them know that you need to withdraw funds from the account for an indirect or 60-day rollover. Follow the custodian’s withdrawal process.

- After receiving the check from your custodian, endorse the back portion and send it to The Entrust Group at: “The Entrust Group, Inc. FBO [Client Name] Account # [Entrust Acct. Number]”

- Here’s an example: The Entrust Group, Inc. FBO John Smith Account #12345

- Once we’ve received your check and deposited the funds into the account, you will receive a confirmation email. If you don’t receive a confirmation email within 7-10 business days of sending the check, please contact us for an update.

That’s all there is to it.

Once you’ve funded your SDIRA, don’t forget to tell your friends. If they fund an account with Entrust, we’ll not only waive their $50 account opening fee, but we’ll also slash $50 off your annual recordkeeping fees. This can save you up to $500 per year, reducing or entirely eliminating your recordkeeping fees.

Can I Roll Over My 401(k) Plan into a Roth IRA?

Yes, you can roll over your 401(k) into a Roth IRA, but there are important considerations to keep in mind.

When you complete a rollover from a traditional 401(k) to a Roth IRA, it is referred to as a Roth conversion. The amount you convert will be treated as taxable income in the year of the conversion. So, deciding when to do a Roth conversion is crucial. Converting during a year when your earnings are lower may help reduce your income tax bill.

It's also important to note that once you do a Roth conversion, the funds in the Roth IRA will be subject to a five-year holding period before qualified distributions can be made tax-free.

If you only want to convert a portion of your 401(k) to a Roth retirement account, you may perform a partial conversion. This strategy allows you to convert a specific portion of your 401(k) funds while leaving the rest in the 401(k) or rolling them into a traditional IRA account.

If you’d like to roll over your 401(k) funds into a Roth SDIRA at Entrust, you’ll need to complete a rollover to a traditional IRA before completing the Roth conversion. Here are the steps you’ll need to follow:

- Complete your 401(k) rollover into a traditional IRA, as outlined earlier in the article.

- Complete the One-Time Distribution Form and submit it to Entrust.

- Complete the online or PDF Rollover Certification Form and submit it to Entrust.

- If it’s an in-kind rollover, complete the online or PDF Fair Market Valuation Form and submit it to Entrust.

Choosing the Right Self-Directed IRA Custodian

As an employee, you likely didn’t have a say in choosing your 401(k) administrator. Often, the differences between 401(k) administrators are relatively minimal.

That’s not the case with SDIRA providers. As your account is self-directed, you’ll need to instruct your custodian to fulfill each transaction. You will likely develop a closer relationship with them. That’s why selecting a trustworthy and experienced SDIRA custodian is crucial for successful self-directed investing.

Look for custodians with a solid track record, a deep understanding of self-direction, and a reputation for excellent customer service.

Make a list of questions you have about investing with an SDIRA. Call up their team and ask them about the processes for making transactions, reporting taxes, and general account management. Finally, explore whether the provider’s fee structure aligns with your financial goals.

Once you’ve completed your due diligence, you can embark on your self-directed investing journey with confidence.

Not sure which SDIRA provider to go with?

Rollover Your Retirement Funds to an SDIRA at Entrust

In an era of increasing job-switching, protecting your retirement funds from needless taxes and penalties is essential for financial growth. Rather than emptying out your 401(k), take control of your retirement funds with an SDIRA.

The rollover process is simple and straightforward. With self-direction, you can access a wider range of investment options, and achieve even greater diversification. By following a few simple steps, you can move your 401(k) funds into an SDIRA and begin your self-directed investing journey.

If you run into any issues completing your rollover, don’t hesitate to reach out. Call our client services team at 1-(800)-392-9653. They’ll be happy to help guide you through the process, no matter what stage you’re at.

Have more general questions about self-directed IRAs? Book a free consultation with one of our IRA experts or download our SDIRA Basics Guide to learn more about what you can and can’t invest in with your new SDIRA.

0 Comment