Tax-Deferred vs Tax-Free: How to Pick the Right Plan

Estimated reading time: 6 minutes

One of the biggest perks of investing with a retirement account is the potential tax reduction on your investment returns.

There are two primary tax strategies you can take advantage of: tax-free and tax-deferred. Both options come with their own sets of benefits and considerations, making it essential to weigh them carefully.

In this blog post, we'll delve into the intricacies of tax-deferred and tax-free retirement plans, providing you with insights and guidance you need to make an informed decision that aligns with your long-term financial goals.

What Does Tax-Deferred Mean?

“Tax-deferred” means that you postpone paying taxes on your contributions until a later time, typically when you withdraw funds from the account in retirement. This can give your investments more time to grow, as they won't be subject to annual taxation. However, you will eventually have to pay taxes on your withdrawals, which may be at a higher or lower tax bracket than your current one.

Types of Tax-Deferred Plans

Several tax-deferred plans are available to individual investors and employees, each with its own rules and advantages. Here are some common types:

- Traditional IRA: Qualifying individuals can contribute pre-tax dollars to a traditional IRA, and earnings grow tax-deferred until withdrawal.

- 401(k), 403(b), and 457(b) Plans: Typically offered by employers, 401(k) plans allow employees to contribute a portion of their salary before taxes. Employers may match contributions, and the investments grow tax-deferred.

- SEP IRA: Geared towards self-employed individuals and small business owners, this plan allows for tax-deferred contributions and flexibility.

- SIMPLE IRA: Designed for businesses with 100 or fewer employees, SIMPLE IRAs offer a streamlined and cost-effective alternative to traditional 401(k) plans.

Pros and Cons of Tax-Deferred Plans

While these retirement plans offer significant tax benefits, it's crucial to weigh the potential downsides and consider your long-term tax situation. Here are some of the greatest benefits and drawbacks of these plans:

Pros:

- Reduce Current Tax Bill: Contributing to tax-deferred accounts can reduce your taxable income for that year, lowering your current tax liability. Keep in mind that your ability to contribute to these accounts is governed by annual income and contribution limits.

- Tax-Deferred Investments: Immediate tax savings through deductible contributions and tax-deferred growth, granting investments the opportunity to compound more efficiently over time.

- Employer Matching Contributions: Many employers offer matching contributions to tax-deferred retirement plans, significantly increasing your savings.

Cons:

- Tax Upon Withdrawal: You'll eventually pay income tax on withdrawals, which may be higher than expected if your tax bracket increases over time.

- Penalties for Early Withdrawal: Unless you meet certain exemption requirements, all withdrawals before age 59½ incur penalties, in addition to ordinary income taxes.

- Required Minimum Distributions (RMDs): Starting at age 73, you must take RMDs from most tax-deferred plans, which can impact your tax situation.

- Income Limits: Your ability to make deductible contributions to some tax-deferred plans, including traditional IRAs, is determined by income limits.

Tax-Free Plans

First introduced in 1997, tax-free plans are investment accounts that offer the unique advantage of shielding your contributions, earnings, and withdrawals from tax.

These accounts require after-tax dollars, which means you've already paid income tax on the funds. Once your money is inside a tax-free account, it enjoys tax-free growth. This means that your investments can grow without any annual tax obligations. Plus, when you withdraw funds, you won't owe any federal income taxes or capital gains taxes, as long as you meet specific requirements.

Types of Tax-Free Plans

There are several tax-free plans that eligible investors can take advantage of:

- Roth IRA: Roth IRAs allow individuals to contribute after-tax dollars, and all qualified withdrawals, including earnings, are entirely tax-free after age 59½, provided you've held the account for at least five years.

- Roth 401(k): Some employers offer the option to contribute after-tax dollars to a Roth 401(k), offering the benefits of a Roth IRA with the expanded contribution limits of a 401(k).

- HSA (Health Savings Account): HSAs offer tax-free contributions and tax-free withdrawals when used for qualified medical expenses. They can serve as both a savings vehicle for healthcare costs and a long-term investment account.

- ESAs (Education Savings Accounts) and 529 Plans: These education savings plans allow tax-free growth and withdrawals when used for qualified education expenses, making them an excellent choice for funding educational pursuits.

Pros and Cons of Tax-Free Plans

Tax-free investment accounts offer a compelling array of advantages, although they are not without their drawbacks:

Pros:

- Tax-Free Growth: Because contributions have already been taxed, investments can grow tax-free, potentially leading to significant savings over time.

- No RMDs: Unlike tax-deferred retirement accounts, tax-free plans do not mandate distributions during the account holder's lifetime, allowing for more control over your legacy planning.

- Penalty-Free Withdrawal of Contributions: At any time, you can withdraw your original contributions (though not earnings) to these plans without incurring penalties, providing liquidity and flexibility.

Cons:

- Income Eligibility Restrictions: Certain tax-free plans, like Roth IRAs, have income eligibility requirements that can limit participation for higher-income individuals.

- No Immediate Tax Benefit: Contributing to these plans involves after-tax income, so there is no immediate tax benefit.

How to Choose the Right Plan For You

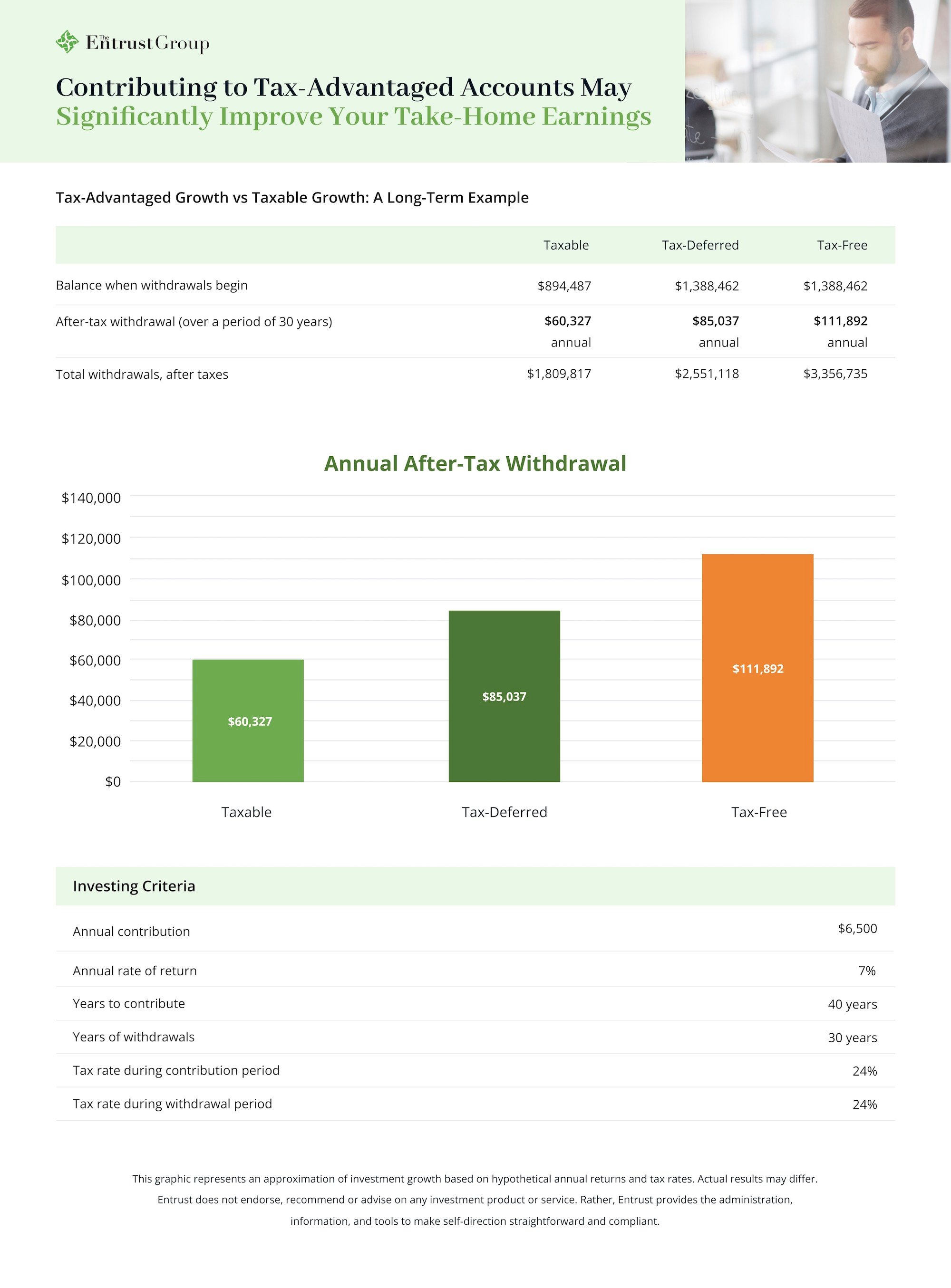

The first thing to understand is that regardless of the plan you choose, contributing to tax-deferred and/or tax-free plans can significantly improve your take-home earnings:

However, this doesn’t make the choice for you.

The choice between tax-free and tax-deferred growth depends on your individual circumstances and financial goals. Here are some factors to consider when making your decision:

Expected Tax Bracket in Retirement

If you anticipate being in a lower tax bracket during retirement, tax-deferred growth may be advantageous. If you’re correct, you'll pay taxes at a lower rate in retirement, leading to potential tax savings in the long run.

On the other hand, if you expect to be in a higher tax bracket in retirement, tax-free growth options like Roth IRAs or Roth 401(k)s may be more appealing. While you won't receive an immediate tax deduction for contributions, your withdrawals during retirement will be tax-free. If these withdrawals would otherwise be made in a high tax bracket, you will have reduced your overall tax liability over the course of your lifetime.

Current Financial Situation

If your budget doesn't offer much flexibility for savings, you may want to opt for a tax-deferred plan. By making contributions, you can effectively reduce your taxable income and current tax liability. This allows you to allocate more towards savings and investments without a substantial decrease in your monthly income.

Legacy Planning and Wealth Transfer

If one of your investment goals is to leave a substantial legacy for your heirs or charitable organizations, the choice between tax-free and tax-deferred growth becomes critical.

Tax-deferred plans require you to start taking RMDs after reaching age 73, potentially reducing the amount you can leave to heirs or charities. Roth IRAs, in contrast, do not have RMDs during your lifetime, allowing your investments to grow tax-free for a more extended period.

Tax Diversification

Building a resilient portfolio often hinges on the art of asset diversification. The same principle extends to your tax strategy.

Consider allocating a portion of your investment portfolio to tax-deferred growth and another portion to tax-free growth. This strategy is known as tax diversification, and it's all about creating a well-balanced financial portfolio that can gracefully navigate shifting tax landscapes and individual circumstances.

The ultimate goal? To minimize your lifetime tax burden and maximize financial flexibility.

Tax rates are rarely static; they can ebb and flow due to shifts in legislation or your personal financial journey. By diversifying your investments across various tax treatments, such as tax-deferred, tax-free, and taxable accounts, you can effectively hedge against the risk of substantial taxation down the road.

Maintaining a mix of these accounts also grants you flexibility when it comes to withdrawing funds during retirement. With this versatility, you can strategically tap into different accounts to manage your tax bracket on an annual basis, potentially reducing your overall tax liability.

Finally, major life events like marriage, the birth of a child, career changes, or retirement can substantially alter your tax situation. A diversified tax strategy offers the adaptability needed to navigate these unexpected twists and turns with confidence.

Carve Your Path to Financial Freedom

Tax-deferred and tax-free plans both offer unique advantages, making them valuable tools for building a diversified retirement portfolio. Understanding the nuances of each plan and how they fit into your overall financial goals is crucial for making informed decisions.

Ultimately, the best choice for you depends on your individual circumstances and financial goals. Consult with a trusted financial or tax advisor to develop a personalized tax-advantaged investment strategy that aligns with your specific needs and objectives.

And remember, the path to your financial future starts with an investment in the most valuable asset: education. Fortunately, we have a wealth of in-depth content for you to consider as you shape your tax and investing strategy:

Additional Resources

- Tax Free vs Tax-Deferred Guide: Dive deeper into the key differences between these two types of accounts and gain valuable insights into how to choose the right one for your financial situation.

- Tax Free or Tax-Deferred Webinar: Explore our expert-led webinar on the primary factors you should consider when deciding between tax-free and tax-deferred growth.

- Learning Center: Browse our ever-expanding catalog of educational content covering a wide range of financial topics, like investment strategies, retirement planning, and tax optimization.

0 Comment