Download our industry leading mobile app to manage your account from almost anywhere

One-time account establishment fee for opening a self-directed IRA, per account

A single asset

Two or more assets

Purchase, sale, or exchange of real estate

(includes earnest money deposit, if applicable)

Purchase, sale, or exchange of real estate note

(includes note payoff, if applicable)

Purchase, sale, or exchange of real estate with non-recourse loan

(includes earnest money deposit, if applicable)

Purchase, sale, or exchange of precious metals

(precious metals depository fees, such as storage and shipping, may apply)

Purchase, sale, or exchange of crowdfunding

(only if investing with the following companies: WeFunder, SharesPost, Realty Mogul, Funders Club, EquityZen, and CrowdStreet)

Purchase, sale, exchange or additional funding of all other alternative assets

ACH transfers, incoming and outgoing

Checks

(includes all check requests)

Wire transfers, incoming and outgoing

Cashier’s check or other official bank check

Standard overnight delivery via FedEx, UPS, or USPS

Dispute of fees on credit/debit card

Returned items of any kind and stop payments, per item

Re-registration of assets plus expenses of transfer agents

Research of closed assets or accounts, legal inquiries, unclaimed property investigations, and other special transaction handling

Rush fees for expedited transaction processing or services within the same or next day

Account termination processing fee

*The uninvested cash in your account is not charged a 0.17% fee, regardless of the amount of cash held in there. The 0.17% fee is assessed solely on the total asset value above $50,000. For example, an account with two assets of a total value of $150,000 and $12,000 cash would pay a fee of $329 + 0.17% of $100,000 ($170), or a total of $499 annually.

There is a cap on recordkeeping fees at $2,299 per year, so no matter how much your account grows, you know you will never pay more.

Benefit from the best

I have been an Entrust client for several years and without exception, pre and post COVID-19, they have been the most responsive, courteous, knowledgable, client-focused group, I have ever worked with.

Combine this with the fact that Entrust offers a unique platform of learning and investment products, Entrust gives you the ability to be an incredible hands-on or 100% passive investor. Keep doing what you are doing Entrust.

At Entrust, we have designed our fees to adapt to every type of investor. Whether you invest $20,000 or $2,000,000 in a self-directed account, our fees are scaled to match the complexity of administering your account and make sure you have quality service and access to SDIRAs at a reasonable price.

Here are our four main fee types:

Many investors are surprised to learn that using retirement funds to invest in alternative assets has been possible since 1974. However, most brokerage firms and banks focus on offering publicly traded securities, like stocks and bonds, because they lack the infrastructure and expertise to manage privately held assets, such as real estate or private equity. As a result, they tend not to promote self-directed IRAs, which offer the flexibility to invest in a broader range of assets.

No, you cannot invest in your own business with a self-directed IRA. The IRS prohibits any transactions between your IRA and your own business because you, as the owner, are considered a disqualified person.

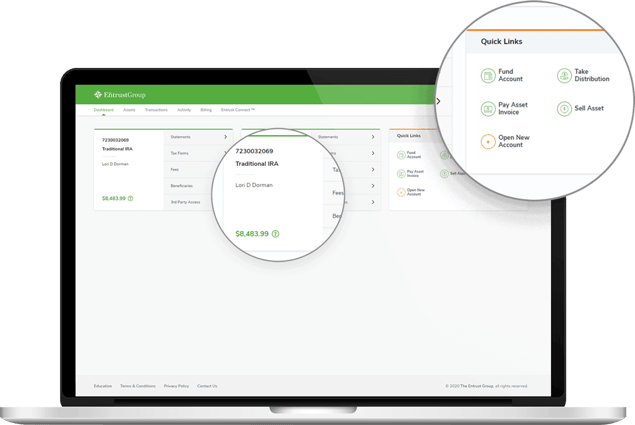

Our process is quick and straightforward. Follow these steps:

When managing a self-directed IRA (SDIRA), several key rules must be followed to maintain the tax-advantaged status of the account. Here are some of the primary guidelines:

Yes, there are several potential disadvantages to a self-directed IRA (SDIRA). Here are some key considerations:

Before opening an SDIRA, it’s important to weigh the potential advantages and disadvantages based on your specific financial goals and risk tolerance.

No, you cannot invest in your own business with a self-directed IRA. The IRS prohibits any transactions between your IRA and your own business because you, as the owner, are considered a disqualified person.