Unlike other IRAs held at banks, brokerage firms and other institutions, you’re not limited to stocks, bonds, or mutual funds. A truly Self-Directed IRA allows you to take advantage of investing in alternative assets - such as limited partnerships, LLCs, gold, real estate and more. With Entrust as the administrator of your account, you have the power to take your own path in your retirement planning.

That’s right, you can leverage almost any type of asset as an investment vehicle - including real estate, precious metals, private equity, notes, and many other alternative investments.

This is perhaps the most common reason investors choose a SDIRA. The investor will need to find a company, like Entrust, that has the expertise and infrastructure to handle alternative investments.

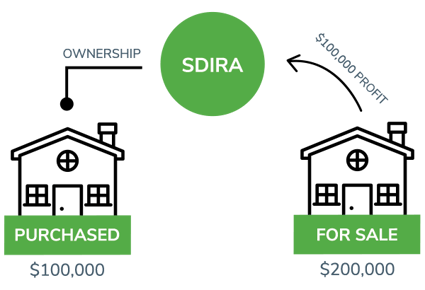

You purchase a home for $100,000 and then sell it for twice that amount. If this property was a part of your SDIRA, the profit would go directly into your IRA and ultimately be tax-deferred, allowing it to potentially grow tax-free.

Now pretend that you rent this same piece of real estate out annually for $40,000. If this property was a part of your SDIRA, once again, this income would go directly back into the IRA and ultimately be tax-deferred.

| Bottom line: with the help of a self-directed IRA you can build up your retirement savings, while simultaneously enjoying the tax benefits. |

Real Estate IRAs are among the most popular alternative investment strategies here at Entrust. Single-family homes, office buildings, and mortgage notes are common investments that yield a profit for many under this type of IRA. Here are a few reasons to invest in real estate:

The guidelines around self-directed IRAs are not much different from other retirement accounts, but it’s important to familiarize yourself with Self-Directed IRA rules and regulations. These include IRA contribution limits, prohibited transactions, distribution rules and more.

The process of investing with a self-directed IRA is not much different than investing with other IRAs, but it’s important to familiarize yourself with the basics such as the process, investment options, and rules.

Check out our Learning Center, the largest knowledge base online for self-directed IRAs, answering virtually every question you may have.

Why stop at stocks, mutual funds, and CDs? With Entrust, you can invest in virtually any alternative investment.

Protect yourself from unsteady stock markets by expanding your portfolio into real estate, precious metals, or private business.

Grow your savings tax-free with a Self-Directed Roth IRA or defer taxes with a Self-Directed Traditional IRA. Your choice. From individual plans to small business accounts, there are many types of retirement plans available to you based on your goals.

Set up your retirement account quickly and easily, then finance it in a way that’s convenient for you. Transfer your IRA from another custodian, rollover your 401(k), or start today by making cash contributions.

At Entrust, we have designed our fees to adapt to every type of investor. Whether you invest $20,000 or $2,000,000 in a self-directed account, our fees are scaled to match the complexity of administering your account and make sure you have quality service and access to SDIRAs at a reasonable price.

Here are our four main fee types:

Many investors are surprised to learn that using retirement funds to invest in alternative assets has been possible since 1974. However, most brokerage firms and banks focus on offering publicly traded securities, like stocks and bonds, because they lack the infrastructure and expertise to manage privately held assets, such as real estate or private equity. As a result, they tend not to promote self-directed IRAs, which offer the flexibility to invest in a broader range of assets.

Yes, real estate is one of our clients’ most popular investments, sometimes called a real estate IRA. Clients have the option to invest in everything from rental properties, commercial real estate, undeveloped land, mortgage notes and much more.

Our process is quick and straightforward. Follow these steps:

When managing a self-directed IRA (SDIRA), several key rules must be followed to maintain the tax-advantaged status of the account. Here are some of the primary guidelines:

Yes, there are several potential disadvantages to a self-directed IRA (SDIRA). Here are some key considerations:

Before opening an SDIRA, it’s important to weigh the potential advantages and disadvantages based on your specific financial goals and risk tolerance.

No, you cannot invest in your own business with a self-directed IRA. The IRS prohibits any transactions between your IRA and your own business because you, as the owner, are considered a disqualified person.

For over 40 years, The Entrust Group has provided account administration services for self-directed retirement and tax-advantaged plans.

Entrust can assist you in purchasing alternative investments with your retirement funds, and administer the buying and selling of assets that are typically unavailable through banks and brokerage firms.

We’re not just another Self-Directed IRA administrator; we’re the originator. Ours is expertise you can count on.

Supercharge your alternative investment strategy with the educational content from our Learning Center.

Our team is devoted to helping you self-direct your account(s). You can depend on us to be timely, accurate, and friendly.

Manage your Entrust account online 24/7 with our client portal (voted “Best Online Portal” by Investopedia) and our mobile app.

Streamline your transactions with this prepaid asset management card. The myDirection Visa Card provides immediate access to your funds so you can pay real estate investment expenses on the go.