Tax Tips for Self-Directed IRA Holders

Estimated Reading Time: 7 minutes

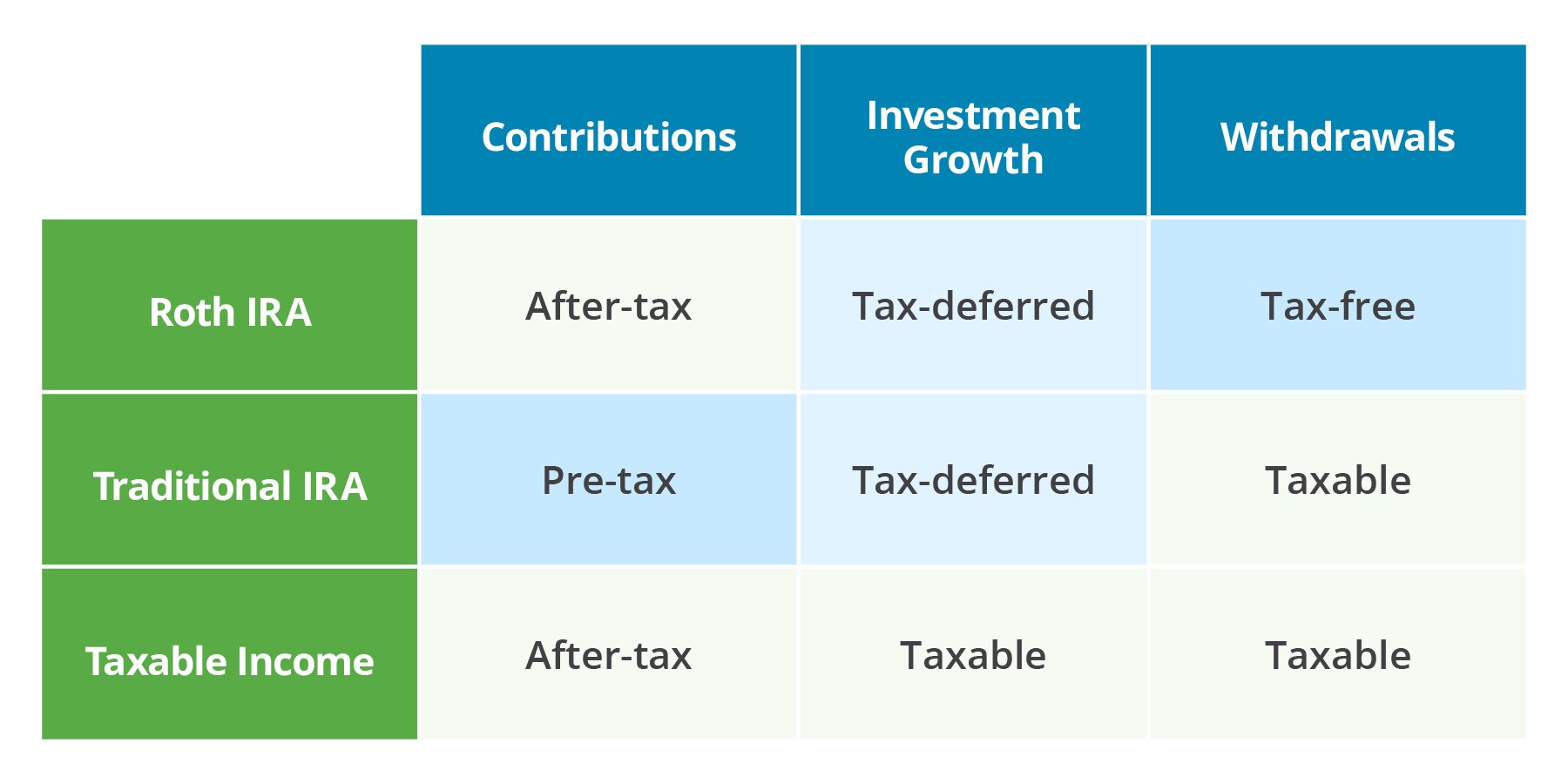

Opening an IRA has long been an effective way for individuals to reduce their annual tax liability. This investment account affords tax-advantaged growth, allowing IRA holders to defer a portion of their income tax bill or set their savings up for tax-free distribution.

Of course, the IRS rules and regulations can feel labyrinthian at times, so IRA holders often come to us with burning questions come springtime.

In this post, we’ll answer some of the top questions that self-directed IRA (SDIRA) holders ask us each year. As a bonus, we’ll introduce you to four tips for potentially reducing your tax bill and making the most of your savings before the 2025 filing deadline on April 15, 2026.

How Is a Self-Directed IRA Taxed?

One of the first questions to ask in the realm of IRA taxation is, “does a self-directed IRA file a tax return?”

On an individual tax return, the IRS requires you to report all taxable income accrued during the year, including IRA distributions. From there, the agency can determine whether you paid too little or too much in the form of income tax. Fortunately, because SDIRAs are tax-advantaged vehicles, earnings are not typically subject to tax on an annual basis.

While an SDIRA holder does not need to file an annual tax return, they do need to provide their SDIRA custodian with the fair market value (FMV) of their account each year. If they are scheduled to take a required minimum distribution (RMD), that mandated amount is directly tied to this value.

With publicly traded assets like stocks, bonds, and precious metals, market value is easy to determine. With alternative assets, the picture’s a bit murkier, so the account holder is required to maintain an updated FMV each year. This ensures that the SDIRA custodian can report an up-to-date account value to the IRS.

Ready to learn the ropes? Dive into our SDIRA Rules Guide

When Would My SDIRA Owe Taxes?

The primary reason your SDIRA would owe taxes is if it has collected unrelated business taxable income (UBTI) or unrelated debt financing income (UDFI).

UBTI is business or trade income that is not related to the tax-exempt purpose of the organization. UDFI is generated when an IRA takes on debt to purchase a larger asset.

If either of these incomes were tax-advantaged, businesses funded with retirement accounts would wield an unfair edge in taxation. Imagine trying to compete with a landlord or laundromat that could pay 10-20% less in taxes.

The result would be an anti-competitive environment. So, all unrelated business revenues must be reported to the IRS using Form 990-T.

If you’re unsure of whether your SDIRA has collected either UBTI or UDFI, read through our UBIT/UDFI webpage or contact your account administrator.

Does a Self-Directed IRA Need an EIN?

Most SDIRAs do not need their own Employer Identification Number (EIN). That said, there are a few exceptions. Here are the two primary reasons why an EIN might be necessary:

- Your SDIRA collected UBTI or UDFI

- Your SDIRA is part of a single-member or multi-member LLC

Remember, SDIRAs that generate UBTI or UDFI are required to pay income tax. If your account qualifies, you’ll need to file a separate tax return with Form 990-T for the IRA. This form requires an EIN.

Second, if you’ve taken advantage of checkbook control via a single-member or multi-member LLC, you will need to file Form W-9 for the LLC, which also requires an EIN. To obtain an EIN, you’ll need to apply with the IRS prior to the deadline.

How Does Form 5498 Affect My Taxes?

Form 5498 reports all contributions made to an IRA, including contributions, rollovers, conversions, and recharacterizations. This form also reports the fair market value of an IRA on December 31 of that year.

5498 also informs the IRS which individuals must take a required minimum distribution (RMD) during the year. If the IRA holder is 73 or older, the IRS requires them to take a distribution and pay the deferred income tax on that distribution, when applicable. Otherwise, the amount not distributed will be subject to a penalty.

Four Strategies That May Reduce Your Tax Bill Before The Deadline

If you have any more questions on taxes for your IRA, be sure to read through our Five IRA Tax Forms blog post, or talk to your tax or financial advisor.

Now, here are four tips for reducing your tax bill and maximizing your tax-advantaged funds in the years to come.

1. Max Out Your Contribution

If you haven’t maxed out your contribution limits for 2025, now’s the time to take advantage of tax-advantaged growth.

The math is relatively straightforward—the more you contribute, the lower your tax bill will be over your lifetime, providing certain conditions are met.

For Instance:

Let’s say a California resident filed the state median earnings of $100,600. If they do not fund a tax-deferred retirement account, they would owe the IRS around $13,700 in income taxes. However, if that same investor met their contribution limit for a tax-deferred plan like a traditional IRA, they would owe only around $12,100 on their tax bill, a difference of about $1,600.

While this example demonstrates the advantages of tax-deferred accounts, the benefits of SDIRAs can be even more prominent with Roth accounts.

2. Opt For a Roth IRA

Roth IRAs have exactly the same contribution limits as traditional IRAs, so how can a Roth IRA lead to a lower tax bill than a traditional IRA?

All contributions to a Roth IRA are made with post-tax dollars. While the $7,000 contribution limit might seem equivalent on paper, a Roth contribution could be worth substantially more down the line. To find out how much more, let’s examine the hypothetical case of Bob and Alice.

Bob and Alice

Alice puts away $500 each month into a Roth SDIRA that averages 7% annual growth. After 30 years of steady savings, Alice’s account would be worth a healthy $610,000.

Now, Bob saves $500 each month in a traditional SDIRA that also averages 7% annual growth. After 30 years, Bob’s account would be worth an identical $610,000.

However, once Bob starts taking distributions, he’ll find his savings deflate as the IRS finally collects on its long-deferred tax bill. If Bob is in the 24% tax bracket come distribution time, his account will actually generate about $150,000 less in returns than Alice’s.

Meanwhile, if Alice avoids prohibited transactions, maintains her IRA’s tax-advantaged status, and waits patiently to take qualified distributions, she’ll find every penny in her IRA will make its way to the beneficiary, given that all funds in her IRA are usable for retirement income and upon death.

Of course, a Roth IRA is not a one-size-fits-all solution. It all depends on your unique financial goals. In many cases, tax-deferred accounts can actually contain more advantages.

For instance, if you’re likely to be in a lower tax bracket in retirement, then tax deferral can lead to a larger nest egg over a similar Roth account. Further, if meeting Roth contribution limits leads to an unhealthy strain on your budget during your working years, then tax deferral could be a better option.

All that said, if maximizing earnings on direct contributions is one of your top priorities, then a Roth IRA might be your best bet.

3. Don’t Forget to Take Your RMD

In 2019, the original SECURE Act increased the required minimum distribution age from 70 ½ to 72. The SECURE Act 2.0 increased the age to 73 in 2023, and further to age 75 starting in 2033.

Fortunately, the Secure Act 2.0 lowered the penalty for missing an RMD from a 50% excise tax on the undistributed amount to a 25% tax. If the IRA holder corrects the failed undistributed amount within two years, the excise tax may be decreased to 10%.

At Entrust, we’re firm believers that the best excise tax is no excise tax.

Be sure to take any scheduled RMDs before the deadline to make the most of your hard-earned savings.

4. Open an SDIRA

Many IRA holders find the investment options offered by banks or brokerages limiting. While stocks, bonds, and mutual funds can be valuable passive investment vehicles, their valuation is inextricably tied up in the whims of the markets.

With an SDIRA, investors are able to take advantage of a wider range of assets, including real estate, private equity, precious metals, and so much more. Many find it liberating to invest in assets they’re comfortable with, and enjoy taking a more active role in managing their tax-advantaged earnings.

Of course, SDIRAs are likely not ideal for set-and-forget investors. Most alternative assets require additional care and due diligence. Indeed, the responsibility of vetting each asset prior to purchase lies entirely with the SDIRA-holder.

Many of our clients find the increased responsibility more than worth it, especially when measured against the benefits of asset diversification and a hand-selected retirement portfolio.

Unlock Your Investing Potential With Entrust! Open my account now

Fund Your SDIRA Before the Tax Deadline

If you have any discretionary funds waiting to be invested and you haven’t maxed out your contribution, you could miss out on tax-advantaged growth.

Take advantage of all that SDIRAs have to offer, from the peace of mind afforded by greater diversification to the joys of a more personal, community-driven portfolio.

If you can’t decide between traditional or Roth, find out which account type is right for you by checking out our tax-free or tax-deferred blog post or downloading our SDIRA Basics Guide.

0 Comment