SEP IRA vs SIMPLE IRA for Small Business Owners

Small businesses might not dominate the headlines like major corporations, but they are arguably the backbone of the American economy.

Consider this: what portion of U.S. businesses would you guess are small businesses?

The answer is a staggering 99.9%. With over 33 million of these businesses across the country, small enterprises are far more than just side gigs; they are a critical source of job creation, responsible for generating nearly two-thirds of all new jobs.

This importance underscores the need for small business employees to feel valued and secure in their roles. That’s why it’s vital for small business owners to provide retirement plans that ensure their employees’, and their own, long-term financial stability.

SEP IRAs and SIMPLE IRAs are two retirement plan options specifically designed to meet the needs of small businesses, each offering distinct advantages. In this article, we’ll delve into the nuances of SEP and SIMPLE IRAs. We’ll provide clarity on their differences and key attributes to give you the information you need to determine the best fit for your small business.

Table of Contents

- What are the Differences Between SEP and SIMPLE IRAs?

- What Are the Contribution Limits for SEP and SIMPLE IRAs?

- What are the Tax Benefits of a SEP or SIMPLE IRA?

- Leverage Your Business Experience For Your Portfolio

- SEP and SIMPLE IRA Frequently Asked Questions

- Build a Secure Financial Future for You and Your Employees

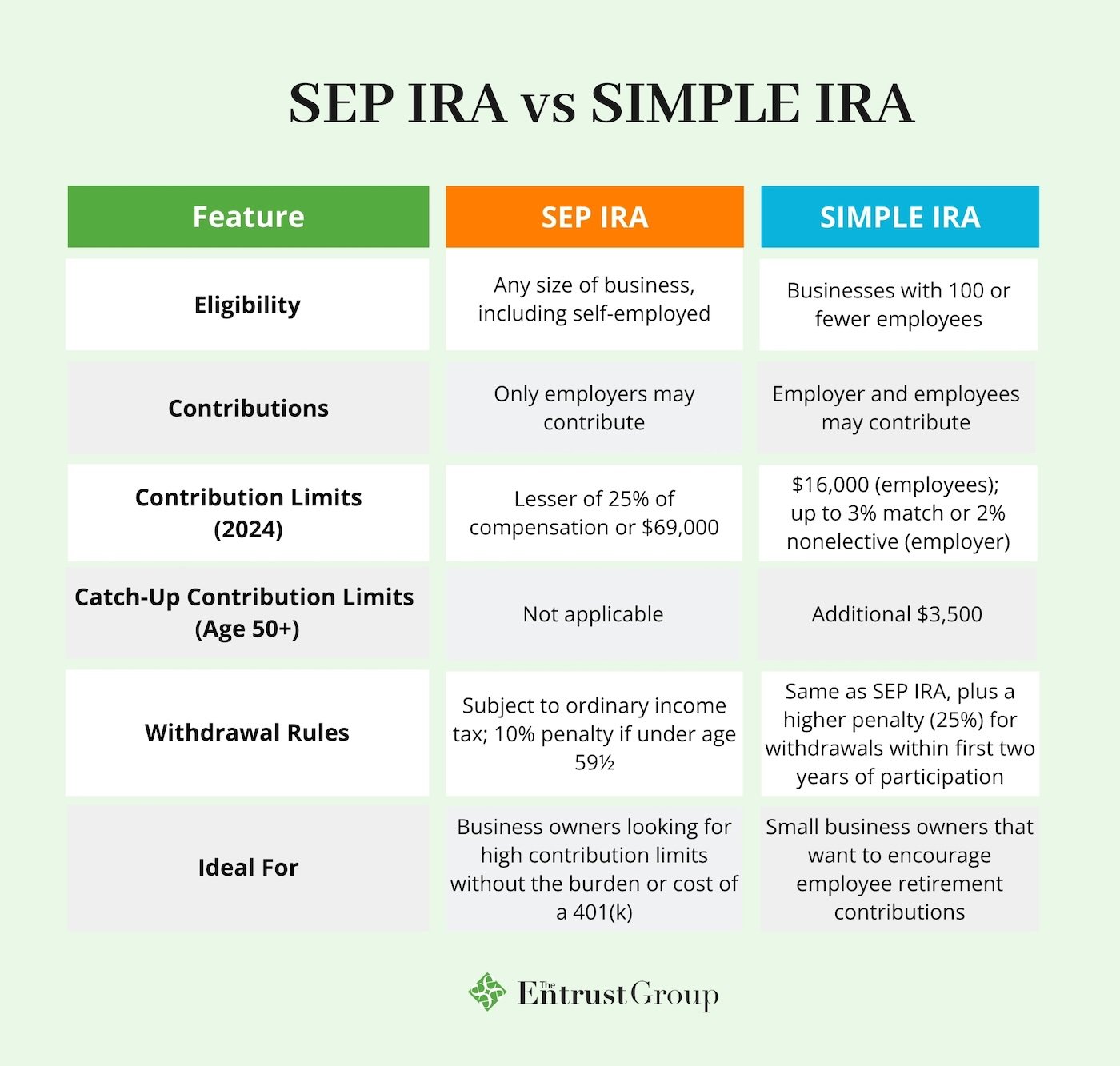

What are the Differences Between SEP and SIMPLE IRAs?

A Simplified Employee Pension, or SEP IRA, is a flexible retirement plan perfect for self-employed individuals or small business owners with few or no employees.

Under a SEP IRA, only the employer makes contributions to traditional IRAs set up for themselves and eligible employees. A standout feature of SEP plans is their higher contribution limits – employers can contribute up to 25% of each employee's pay (subject to annual limits set by the IRS), making it an excellent way to save a significant amount for retirement.

On the other hand, a SIMPLE IRA, or Savings Incentive Match Plan for Employees, is designed for small businesses with 100 or fewer employees. The SIMPLE plan encourages both employees and employers to contribute to traditional IRAs.

While both plans are IRAs and offer tax-deferred growth, there are notable differences.

SEP IRAs offer higher contribution limits and are solely funded by employer contributions. This makes them ideal for businesses where the owner wants to save a lot for retirement, or provide substantial retirement benefits to employees without the complexity of a 401(k).

In contrast, SIMPLE IRAs allow for both employee and employer contributions. This can be advantageous for businesses where employees are eager to contribute to their own retirement savings.

Another difference is the eligibility requirements.

SEP IRAs may be established by a business of any size. They are particularly advantageous if the size of the workforce fluctuates, as there is no requirement for the employer to contribute every year. SIMPLE IRAs, however, are only for businesses with 100 or fewer employees and require consistent annual contributions.

What Are the Contribution Limits for SEP and SIMPLE IRAs?

Understanding the contribution limits of SEP and SIMPLE IRAs is crucial for effective financial planning.

SEP IRA Contribution Limits

For 2023, contribution limit for SEP IRAs is the lesser of $69,000 or 25% of an employee's compensation. For 2025, this limit rises to $70,000. Remember, SEP IRA contributions are only made by the employer — employees cannot make contributions to their account.

However, employees covered under a SEP IRA plan at work still have ways to boost their tax-advantaged funds. As long as they fall under certain income limits, they may be able to make deductible contributions to a traditional IRA or post-tax contributions to a Roth IRA.

SIMPLE IRA Contribution Limits

Unlike SEP IRAs, SIMPLE IRAs may include employer and employee contributions.

In 2024, employees can contribute up to $16,000 to their SIMPLE IRA. Plus, if they are aged 50 or over, they can make a catch-up contribution of an additional $3,500, bringing their total to $19,500.

In 2025, the normal limit is set to rise to $16,500, while the catch-up limit will remain at $3,500 for most plan participants.

However, as a SIMPLE plan participant, you may be able to contribute more to your

Employers must either match employee contributions dollar for dollar up to 3% of their compensation or contribute 2% of each eligible employee's compensation, regardless of whether the employee contributes.

What are the Tax Benefits of a SEP or SIMPLE IRA?

Both SEP and SIMPLE IRAs offer attractive tax benefits, but they each come with specific considerations.

Tax Benefits for Employers

SEP and SIMPLE IRAs both allow employers to deduct contributions on their business tax return. This deduction may significantly reduce the taxable income of the business, providing a direct financial benefit.

Tax Benefits for Employees

Employees benefit from tax-advantaged growth of their investments within both SEP and SIMPLE IRAs. Prior to tax year 2023, contributions to SEP and SIMPLE IRAs could only consist of pre-tax funds, reducing employees’ taxable income.

However, in late 2022, the SECURE Act 2.0 allowed some employees covered under a SIMPLE IRA to begin making Roth contributions to their account. Plus, it allowed employees with a SEP IRA plan to treat their employer contributions as Roth contributions, in part or in whole.

This enhanced flexibility may allow for greater savings down the line, especially if the employee ends up in a higher tax bracket in retirement.

Tax Deadlines and Filing Requirements

SEP IRAs can be established at any time before the tax filing deadline, plus extensions. SIMPLE IRAs must be established by October 1 of that tax year. For example, the deadline to establish a SIMPLE IRA plan for the 2025 tax year is October 1, 2025.

The deadline for SEP IRA contributions is the employer's tax filing deadline, including extensions.

For SIMPLE IRAs, employee contributions must be deposited no later than 30 days after the end of the month in which the employee earned the contributions. Employers must make their matching or non-elective contributions by their tax filing deadline, including extensions.

Both plans require IRS reporting. For SEP IRAs, employers file Form 5305-SEP to establish the plan. For SIMPLE IRAs, employers use Form 5304-SIMPLE or Form 5305-SIMPLE, and they must report annual contributions.

Leverage Your Business Experience For Your Portfolio

As a small business owner, you've already embarked on one of the most challenging forms of investment: pouring capital, time, and effort into your own private venture. Your firsthand experience in growing and managing a business may give you a distinct advantage in identifying promising ventures, potentially leading to long-term rewards.

However, if you have a hefty retirement portfolio like a 401(k) or IRA, you can’t leverage that experience towards investment in privately owned companies — your options are limited to publicly traded stocks, bonds, and mutual funds.

That is, unless you have a self-directed IRA (SDIRA).

These investment accounts open doors to a broader range of investment opportunities beyond traditional securities. With a SEP or SIMPLE SDIRA, you can invest in any asset the IRS allows — including private companies.

Once you’ve opened your SEP or SIMPLE SDIRA, you can leverage your specific industry knowledge and expertise for investment gain.

For example, if your small business operates in the tech sector, you might benefit from concentrating on emerging tech startups. Alternatively, if you operate a service-based business like carpet cleaning, you may have a great eye for spotting similar ventures that outshine the competition.

This focused investment strategy, aligned with your understanding and experience, may lead to more informed decisions and potentially higher returns.

SEP and SIMPLE IRA Frequently Asked Questions

Now that we’ve covered the essentials of SEP and SIMPLE IRAs, here are six of the most commonly asked questions about these small business retirement plans:

Who is eligible to set up a SEP or SIMPLE IRA?

SEP IRAs can be set up by any size of business, from self-employed individuals to large corporations. SIMPLE IRAs are specifically designed for small businesses with 100 or fewer employees who received at least $5,000 in compensation during the preceding year.

Can I contribute to a SEP or SIMPLE IRA if I already participate in another retirement plan?

If you contribute to a SEP or SIMPLE plan, you may still contribute to a traditional and/or Roth IRA.

If you participate in a 401(k) at your day job and a SEP IRA at your small business, you may still contribute the maximum to each plan. That is because a SEP IRA does not entail employee elective deferrals.

However, a SIMPLE IRA does offer employee elective deferrals. So, if you're contributing to a 401(k) and a SIMPLE IRA, the maximum combined annual deferral for both plans is $23,000 for 2024. This limit increases to $23,500 for 2025.

Can I withdraw money from my SEP or SIMPLE IRA before retirement?

Withdrawals can be made at any time, but if taken before age 59½, they may be subject to a 10% early withdrawal penalty in addition to income tax. For SIMPLE IRAs, the early withdrawal penalty is 25% if the withdrawal occurs within the first two years of participation.

Can I take a loan from a SEP or SIMPLE IRA?

No, loans are not permitted from either SEP or SIMPLE IRAs. Any amount borrowed from these IRAs is considered a distribution and is subject to tax and potential penalties.

Can I contribute to a SEP or SIMPLE IRA for a part-time employee?

For SEP IRAs, contributions can be made for employees who have worked for three of the last five years and earned a minimum amount during the year. For SIMPLE IRAs, employees who earned at least $5,000 in any prior two years and are expected to earn at least $5,000 in the current year must be included.

Can my SEP and SIMPLE IRA contributions vary each year?

Yes, your SEP IRA contributions can vary each year or even be skipped entirely. For SIMPLE IRAs, the employer's match or nonelective contributions must be made each year, but the amount can vary within the limits set by the IRS.

Build a Secure Financial Future for You and Your Employees

Opening a SEP or SIMPLE IRA might not just be a wise decision for your financial future; it can be invaluable for your employees’ long-term financial well-being.

The most recent data illustrates that the median retirement savings for those aged 55+ is about $150,000, nowhere near enough to retire on. Starting a retirement savings plan for your team (and yourself) can be a significant step in helping close that gap.

If you’re not sure whether a SEP or SIMPLE IRA makes sense for your unique situation, talk to one of our SDIRA experts. While they cannot provide advice, they can provide all the information you need to make an informed decision.

To explore SEP and SIMPLE IRAs further, download our comprehensive Account Guide or explore our Learning Center. You’ll find dozens of in-depth resources tailored specifically for small business owners, like Small Business Solutions to Retirement Saving and a detailed webinar comparing SEPs, SIMPLEs, and individual 401(k)s.

0 Comment