Can You Have Multiple Roth IRAs?

Estimated reading time: 4 minutes

It’s a simple question with a simple answer.

Yes, you can indeed have multiple Roth IRA accounts. However, it's important to note that having multiple Roth IRAs doesn't affect the annual contribution limits set by the IRS.

So, what drives savvy investors to opt for more than one Roth IRA? That's exactly what we’re going to explore in this blog post.

We'll delve into the advantages and potential drawbacks of holding multiple Roth IRA accounts. Plus, we'll introduce you to a potent investment tool that can significantly broaden the range of investment options available within your Roth IRA, potentially enhancing your retirement portfolio's performance and versatility.

Basics of Roth IRAs

Introduced in 1997 and named after Senator William Roth, the Roth IRA account was designed to give Americans another way to save for retirement with distinct tax advantages:

Post-Tax Contributions: Contributions to a Roth IRA are made with after-tax dollars. So, your original contributions can be distributed at any time without incurring an early withdrawal penalty.

Tax-Free Qualified Distributions: Withdrawals from a Roth IRA made after age 59½ are tax-free, provided the account has been open for at least five years. This includes both the contributions and the earnings.

No Required Minimum Distributions (RMDs): All tax-deferred account holders, including traditional IRA holders, are required to start taking distributions from the account at age 73. This isn’t the case with Roth IRAs. Unlike traditional IRA contributions, the contributions to Roth IRAs have already been taxed. So, they do not require RMDs during the account holder's lifetime.

The Benefits of Roth IRAs

Opening a Roth IRA account can be particularly advantageous for those who expect to be in a higher tax bracket in retirement.

By contributing to a Roth IRA during your working years, you pay taxes on your contributions at your current lower rate. If your prediction is true, you may reduce your lifetime tax bill.

Not sure whether you’ll be in a higher tax bracket during retirement? Funding a Roth IRA still may be a good idea.

Allocating funds in both traditional and Roth IRAs allows for tax diversification. This can be a strategic benefit, giving retirees the ability to choose from which account to withdraw funds based on their current tax situation.

However, not everyone can contribute to a Roth IRA. These accounts have income limits for eligibility, meaning higher-income earners may not be able to contribute.

Can You Open More Than One Roth IRA?

The answer is a resounding yes. The IRS places no limits on how many Roth IRAs you’re able to open or hold.

However, holding multiple Roth IRAs or even multiple types of IRAs does not increase your IRA contribution limits.

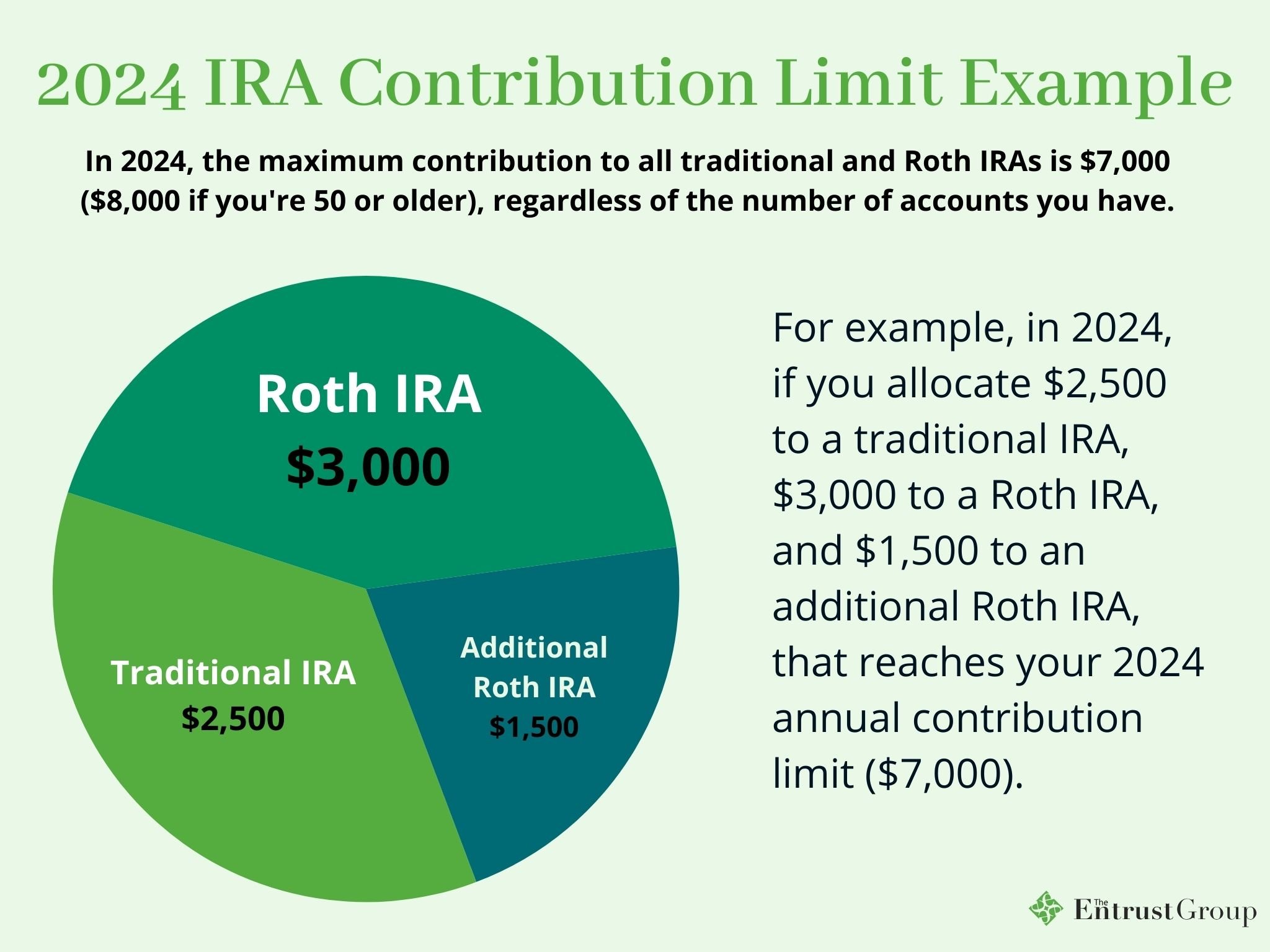

For 2023, the total amount you can contribute to all traditional and Roth IRAs is limited to $6,500 (or $7,500 if you’re age 50 or older), regardless of the number of accounts you hold. In 2024, these limits will increase to $7,000 and $8,000 respectively.

Let’s look at an example. In tax year 2024, if you allocate $2,500 to a traditional IRA, $3,000 to a Roth IRA, and $1,500 to an additional Roth IRA, that reaches your annual contribution limit ($7,000) for the year.

Reasons to Consider Multiple Roth IRAs

A person might consider having multiple IRAs, including multiple Roth IRA accounts, for several reasons:

1. Goal-Oriented Savings

Multiple Roth IRAs can be designated for different financial goals. For example, an individual might use one account for their personal retirement savings and another for qualified education expenses.

Paying for qualified education expenses is one of the few exemptions that allows you to make a penalty-free distribution from a Roth IRA before reaching age 59½. While this separation isn’t strictly necessary, it can help some IRA holders organize their finances according to specific timelines and objectives.

2. Estate Planning

Designating beneficiaries is a crucial step when establishing a Roth IRA. While it's possible to name multiple beneficiaries for a single account, designating different individuals for separate accounts can help prevent conflicts among beneficiaries following your passing.

3. Investment Diversification

Each Roth IRA account can hold different types of investments, catering to various levels of risk and investment strategies. For example, one Roth IRA could be invested in technology stocks for growth potential, while another could focus on alternative assets like multifamily real estate or precious metals for stability.

However, it's important to note that you won't be able to invest in these alternative assets using a Roth IRA held at a bank or brokerage.

Instead, you'll need a specialized retirement account known as a self-directed IRA (SDIRA).

Roth SDIRAs are identical to other Roth IRAs in terms of tax advantages and contribution limits. What sets them apart is their flexibility. With an SDIRA, you can invest in any asset the IRS allows, like real estate, private equity, and cryptocurrency.

It's crucial to navigate the SDIRA landscape with a clear understanding of the associated responsibilities. This includes strict adherence to IRS regulations and a proactive approach to investment due diligence.

To gain a comprehensive understanding of SDIRAs, including important IRS regulations to maintain your account's tax benefits, download our SDIRA Basics Guide.

Things to Keep in Mind

When managing multiple Roth IRA or traditional IRA accounts, it's important to keep accurate records of the total contributions across all accounts. Exceeding your annual limits can lead to penalties.

With each additional retirement account comes additional paperwork. This includes multiple tax forms, as well as various notices regarding service changes, updates, privacy policies, and other essential disclosures.

Fortunately, the Entrust Client Portal is tailor-made to streamline account administration and tax reporting requirements. Our industry-leading platform (according to Investopedia) makes account management a breeze, helping you navigate the responsibilities associated with holding multiple Roth IRA accounts.

Finally, depending on your provider’s fee structure, holding multiple Roth IRAs can increase your total administrative fees.

Frequently Asked Questions About Having Multiple Roth IRAs

Here are four of the most commonly asked questions regarding having multiple Roth IRA accounts:

Can I max out my contribution limits for each Roth IRA?

No. The annual contribution limits for Roth IRAs apply to your total contributions across all traditional and Roth IRAs, no matter how many Roth IRAs or traditional IRA accounts you may have. For tax year 2025, the annual contribution limits are:

- $7,000 for those under age 50

- $8,000 for those over 50

What happens if I exceed the annual contribution limit across all my Roth IRAs?

If you exceed the annual IRA contribution limits, you may face tax penalties and complications with your retirement accounts.

The IRS imposes a 6% excess contribution penalty on the excess amount contributed. This penalty applies each year until you correct the excess contribution. Any earnings generated from the excess contributions may also be subject to taxation.

To correct the excess contribution and avoid penalties, you must withdraw the excess amount, along with any earnings on that excess, by the tax filing deadline (typically April 15 of the following year). This withdrawal is called an "excess contribution distribution." The earnings portion of the withdrawal is also subject to regular income tax.

You are required to report the excess contribution and the corrective distribution when you file your income tax return. Form 5329 is typically used for reporting excess contributions.

Can I combine multiple Roth IRA accounts into one account?

Yes, you can combine two different Roth IRAs into one account.

The most common method for combining Roth IRAs is through a transfer. This means the funds move directly from one Roth IRA to the other without passing through your hands. This helps you avoid any potential tax issues or penalties. Once the transfer is complete, you can close out the empty Roth IRA.

Maintain clear records of the consolidation process for all of your IRA accounts, financial records and tax documentation.

Can I convert a traditional IRA to a Roth IRA?

Yes, this is known as a Roth conversion. However, this will be a taxable event, and you'll need to pay taxes on the amount converted from the traditional IRA.

When you convert a traditional IRA to a Roth IRA, you will need to pay income tax on the pre-tax contributions and earnings in your traditional IRA. This can result in a significant tax liability in the year of the conversion.

Many choose to convert to a Roth IRA when they anticipate being in a lower tax bracket at the time of conversion. Consider your current and future tax situation when deciding to convert.

Broaden Your Retirement Planning Horizons

Roth IRAs can be a vital component of a savvy tax planning strategy, offering unique benefits to enhance your retirement savings. However, it's important to consider a broad spectrum of retirement accounts to optimize your tax benefits and maximize your earnings.

For a comprehensive understanding of the different retirement accounts available, including their distinct tax advantages, download our Account Guide. This guide provides insights into the triple tax benefits of Health Savings Accounts (HSAs) and elucidates the differences between SEP and SIMPLE IRAs.

Have questions about your unique situation? Talk to an SDIRA expert.

They can help you navigate the potential benefits and complexities of a Roth SDIRA, ensuring that your decision aligns with your long-term financial objectives and personal investment expertise.

Or, if you’d like to learn a bit more about retirement planning, browse our Learning Center. Over the years, we’ve added hundreds of informative blog posts, guides, and webinars to our ever-expanding library of free education. Explore topics like how partnering with your SDIRA can greatly expand your purchasing power and how to roll over your old 401(k) to an SDIRA.

0 Comment