[Infographic] Real Estate Investing with a Self-Directed IRA

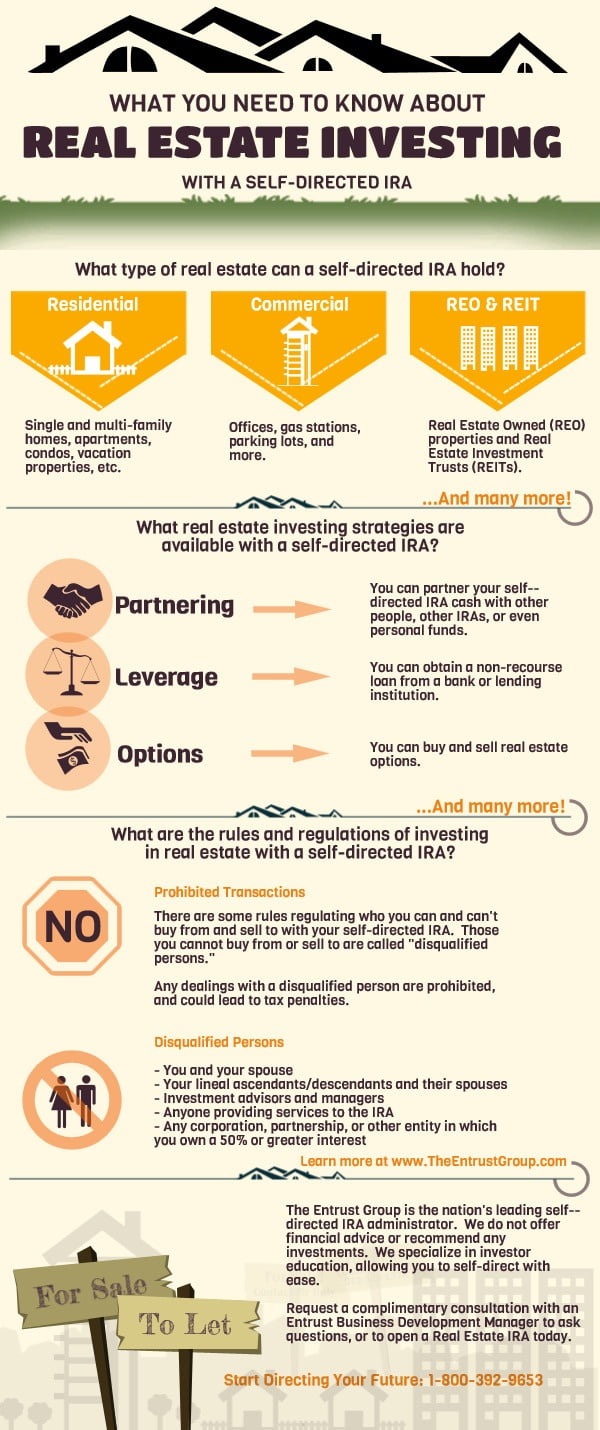

Real estate investing with a self-directed IRA can be the key to saving up for a comfortable retirement. If you are an experienced real estate investor, why not put your industry knowledge to work for your future?

Self-directed IRAs offer significant tax advantages to real estate investors, including tax-deferred or tax-free earnings (depending on the type of account that you use), but many people are unaware that these accounts allow for alternative investments, such as real estate.

If you are looking to diversify your portfolio through the power of a Real Estate IRA, this infographic is a great place to start. Explore some of your available options, popular strategies among investors, and important IRS regulations below:

Share this page:

![[Infographic] The Real Estate IRA Transaction Process](https://www.theentrustgroup.com/hs-fs/hubfs/The%20Real%20Estate%20IRA%20Transaction%20Process.jpg?width=105&height=105&name=The%20Real%20Estate%20IRA%20Transaction%20Process.jpg)

11 Comments