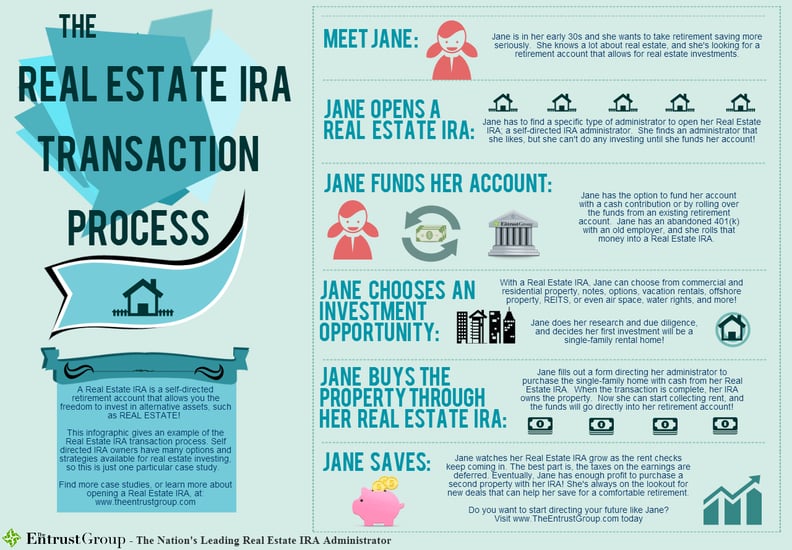

[Infographic] The Real Estate IRA Transaction Process

Real estate is the most popular investment choice among self-directed IRA owners. While many people rely on retirement accounts that only allow for traditional investments, Real Estate IRA investors are diversifying through the innovative use of alternative investments.

So, how can you take advantage of this opportunity yourself? That's what we're here to explain. Once you understand the Real Estate IRA transaction process, you may find that getting started is easier than you expected.

The first step is to open a retirement account that allows for real estate investments, which will require a self-directed administrator, such as The Entrust Group.

Before investing, you will need to fund your account. There are two ways you can do this:

- Cash contribution

- Rollover/transfer money from an existing retirement account

When your account is funded, you are ready to start investing. It's as simple as that! Now you may start picking out investment opportunities, networking, and saving more to ensure a comfortable retirement for yourself. Make sure that you perform due diligence on any investment opportunities (the FBI offers this tip: If the offer of an “opportunity” appears too good to be true, it probably is).

Learn more about the Real Estate IRA transaction process in the infographic below:

![[Infographic] Real Estate Investing with a Self-Directed IRA](https://www.theentrustgroup.com/hs-fs/hubfs/Real%20Estate%20Investing%20with%20a%20Self-Directed%20IRA.jpg?width=105&height=105&name=Real%20Estate%20Investing%20with%20a%20Self-Directed%20IRA.jpg)

![[Infographic] Selling Your Real Estate IRA Property](https://www.theentrustgroup.com/hs-fs/hubfs/_Selling%20Your%20Real%20Estate%20IRA%20Property.jpg?width=105&height=105&name=_Selling%20Your%20Real%20Estate%20IRA%20Property.jpg)

0 Comment