Give Back With Qualified Charitable Distributions (QCDs)

Estimated reading time: 8 minutes

Tax-advantaged growth isn’t just for setting up a healthy nest egg for retirement. It also allows individuals to contribute a portion of their pre-tax funds to charitable causes they believe in.

If you are at least 70½ years old, you can use your existing IRA distribution as a donation to your favorite qualifying tax-exempt entity. This strategy is known as a qualified charitable distribution (QCD), and it’s one of the most effective ways for SDIRA holders to cut down their estate for estate tax purposes.

The distribution contributed to a tax-exempt entity counts towards the individual's required minimum distribution (RMD) if they are aged 73 or older.

This post will highlight which charities qualify for a QCD and break down how making a qualified charitable distribution has the potential to reduce your tax bill.

How To Make a Qualified Charitable Distribution

Historically, the qualified charitable distribution age coincided with the age at which a tax-deferred plan holder must begin taking RMDs: 70½. While the QCD age has remained the same, the RMD age recently increased to 73. This is due to the SECURE Act and SECURE Act 2.0, a pair of legislative bills designed to encourage retirement savings.

Today, tax-deferred retirement plan holders who are scheduled to take an RMD (those 73 or older) can make a qualified charitable distribution. They may then count their QCD toward the amount they must distribute.

For instance, if an IRA holder was scheduled for a $100,000 RMD but directed $60,000 to a qualifying nonprofit, they would only need to take a $40,000 RMD for that tax year.

Making a QCD is simple: direct your IRA administrator to send a check or wire transfer directly to the charity. You may also instruct your IRA administrator to make your distribution payable to the charity and deliver the check yourself.

Qualified Charitable Distribution FAQs

Here are some of the most common questions that IRA holders have about QCDs:

How Do I Know if My IRA Plan Is Eligible for a QCD?

Many different retirement accounts are eligible to make a QCD, including a

-

Traditional IRA

-

SEP IRA (inactive)

-

SIMPLE IRA (inactive)

- Roth IRA (only taxable earnings may count towards the QCD)

A QCD is only available for individuals aged 70½ and over, and the distribution counts toward the account holder's RMD for the year. If these conditions are met, a taxable distribution directed from the IRA to a qualified charity may be treated as a QCD.

Many IRA holders make a QCD directly from a traditional IRA. It’s also possible to initiate a QCD from an inactive SEP or SIMPLE IRA, meaning the account does not receive a contribution for that tax year.

If you’d like to make a QCD from an ongoing SEP or SIMPLE plan, you may transfer or roll over funds from the account to a traditional IRA, initiating the QCD from there. However, contributions to a SIMPLE IRA must be held for at least two years before they’re eligible to roll over into a traditional IRA.

In addition, any contributions made for the year, including your annual IRA contribution, will reduce your eligible QCD amount. Note that you may not make a QCD from any other employer-sponsored plan such as a 403(b) or 401(k).

What is the 2025 QCD Limit? And Will it Change in 2026?

For tax year 2025, up to $108,000 of taxable retirement plan distributions, per taxpayer, are exempt from taxes if the amount is donated directly to a charitable institution. The SECURE Act 2.0 indexed this $100,000 limit for inflation. So, in 2026, this QCD limit will likely increase, though this limit has not been released yet.

Which Charities Qualify for QCDs?

The entity must be a 501(c)(3) organization, meaning donations must be eligible for a tax deduction. If you’re not sure whether an organization qualifies, take advantage of the IRS tax-exempt entity search. Some entities like private foundations and donor-advised funds are not eligible for this tax benefit.

The SECURE Act 2.0, signed into law in late 2022, enabled donors to make gifts from their IRAs to charitable remainder trusts and charitable gift annuities as well.

What Is a Charitable Remainder Trust?

A charitable remainder trust is an irrevocable trust that allows individuals to live up to their philanthropic goals while providing for current living expenses, as long as they are alive. In this charitable giving strategy, donors transfer assets into the trust over a set period of time.

The trust then provides a predictable income stream for a set duration (up to 20 years) or to the end of the beneficiary’s life. At the end of the payment term, the trust passes to one or more qualified charities.

This strategy provides the steady income benefits of annuities while alive. It also sets up a vehicle that will eventually transfer to one or more qualified charities.

What Is a Charitable Gift Annuity?

A charitable gift annuity, on the other hand, is a contract that ties a donor into making a sizable gift to a qualified charitable organization. In return, the donor is able to take a partial tax deduction and receive a predictable income stream from the charity for the remainder of their life.

Keep in mind, IRA holders are able to make only one QCD to a charitable remainder trust or charitable gift annuity during their lifetime. For tax year 2025, the maximum transfer limit is $54,000, though this limit is indexed for inflation.

Note that this one-time $54,000 transfer limit to a charitable remainder trust or charitable gift annuity is distinct from the annual $108,000 QCD limit.

Ready to learn the ropes? Dive into our SDIRA Rules Guide

What Are the Special Tax Reporting Instructions for Making a QCD?

IRS Form 1099-R, among other things, tracks any distributions taken from an IRA during the tax year.

In previous years, QCDs were not reported on Form 1099-R with a specific code. Financial institutions used general distribution codes—such as Code 7 (Normal) for Traditional, SEP, and SIMPLE IRAs, or Code 4 (Death) for inherited IRAs. This placed responsibility on individual filers to identify and exclude the QCD amount from their taxable income when filing IRS Form 1040.

Now, the IRS has updated its instructions for Form 1099-R beginning in tax year 2025. Custodians can now clearly identify QCDs as separate from regular distributions using Code Y. This change will apply to the 2025 tax year and will be reflected on Form 1099-R documents issued to eligible Entrust clients in January 2026.

In the coming months, we’ll update our paper forms and the Entrust Client Portal to include a clear option for indicating when a distribution is a QCD. This will help us report the transaction accurately to the IRS using the proper code on Form 1099-R.

For example, if you have a $10,000 required minimum distribution (RMD) and choose to make an $8,000 QCD, the IRS will now more easily recognize that your taxable RMD has been reduced accordingly. Clearer reporting means smoother tax filing for you.

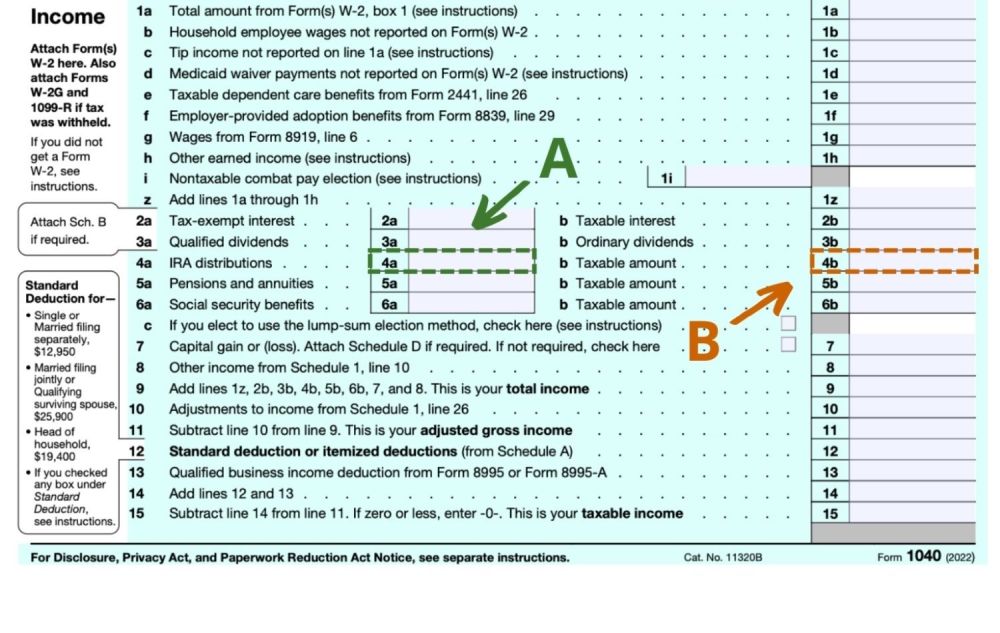

To report a qualified charitable distribution on your Form 1040 tax return, report the full amount of the charitable distribution on the line for IRA distributions, line 4a. One exception is if you distributed more than the amount associated with the QCD.

On line 4b for the taxable amount, enter zero if the full amount was a qualified charitable distribution. If more than the QCD, enter the amount not associated with the QCD. Enter "QCD" next to this line. See the Form 1040 instructions for additional information.

You must also file Form 8606, Nondeductible IRAs, if:

-

You made the QCD from a traditional IRA in which you had basis and received a distribution from the IRA during the same year (other than the QCD), or

-

The QCD was made from a Roth IRA that was not qualified. In this case, the amount does not subtract from an individual’s RMD.

How Can I Determine My Estimated RMD for the Year?

To determine your estimated RMD, enter your prior-year account balance and age into the Required Minimum Distribution Calculator provided by the U.S. Securities and Exchange Commission. Or, you may ask your current IRA custodian to calculate the amount for you.

How Can I Make a One-Time QCD From My Entrust SDIRA?

Simple. Just let us know that you’d like to make a qualified charitable distribution, and we’ll report the amount as a normal distribution on IRS Form 1099-R. You’ll receive this form by January 31 following the year of distribution.

However, you will need to handle the tax exemption of the distribution on IRS Form 1040 of your personal tax return.

Making A Qualified Charitable Distribution From an Inherited IRA

If you’ve recently inherited an IRA, you still must be at least 70½ to make a qualified charitable distribution. If you’re unable to make a QCD, then any distributions will be treated as taxable income.

Keep Your Giving in the Family

In addition to giving to established nonprofits, you may want to extend the spirit of giving to your family and loved ones. This strategy can also present tax benefits for the donor if done correctly.

You may consider:

1. Making Cash Gifts to Family Members

You may give a cash gift under the annual IRS limit to an individual with no tax consequences. In 2025, the annual exclusion per donee is $19,000. If you file jointly, the annual exclusion doubles to $38,000.

Gift amounts are updated yearly, so be sure to check the IRS page. If you plan on taking a distribution from your IRA to make such a gift, the distributions are still subject to the same taxation rules associated with the IRA. If the amount you gifted is above the annual gift tax exclusion, you must file Form 709, the Gift Tax Return.

2. Paying Expenses On Behalf of a Loved One

You can also pay college tuition or medical expenses directly to an educational institution or medical facility on behalf of a family member. If you do this, the limit does not apply, and you can still give that same family member a cash gift. If coming from an IRA, the taxation rules for an IRA distribution still apply.

3. Contributing to an Educational Savings Account

Finally, you may also contribute to a 529 or Educational Savings Account (ESA) for your child’s, grandchild’s, or other relative’s tuition. This applies to elementary, middle, high school, college, and some vocational training institutes.

Although your 529 plan and/or ESA contributions are not tax-deductible, the assets grow tax-deferred until distributed for qualified higher education purposes. Keep in mind, distributions become taxable if they are not used for education purposes.

Start Your Giving With a QCD Today

The holiday season isn’t the only time for giving.

Qualified charitable distributions offer you the chance to give back to your community while reducing your tax bill, all year round. Just be sure to let your SDIRA administrator know. That way, we can help you take advantage of tax savings, making your generosity work for your portfolio.

To learn more about how a self-directed IRA can help you save for retirement and potentially cut back on taxes, schedule a free consultation with an Entrust professional today.

0 Comment