16 Ways to Lower Your Tax Bill

Estimated reading time: 12 minutes

In 2025, the average tax refund neared $3,000, a significant sum that underlines the impact of effective tax planning.

While many taxpayers obtain a substantial refund by opting for the standard deduction, those who are particularly tax-savvy employ a variety of tactics to further reduce their taxable income and boost their savings.

The good news? There are dozens of government-approved methods to minimize your tax liability.

As we edge closer to the 2025 tax filing deadline, it’s the perfect time to explore these 16 practical strategies designed to help you trim your tax bill. From maximizing retirement contributions to leveraging educational and healthcare savings plans, these approaches can enhance your financial health while staying compliant with tax regulations.

Note: This article is for informational purposes only. It is not a substitute for professional advice from a certified financial planner or public accountant.

Table of Contents

- Increase Your Contribution Levels

- Maximize Your Catch-Up Contributions

- Aim For Long-Term Capital Gains

- Adjust Your Withholding

- Take Business Expense Deductions

- Make Charitable Contributions

- Take Advantage of Qualified Charitable Distributions

- Open a Self-Directed IRA

- Health Savings Account

- Flexible Spending Account (FSA)

- Claim Tax Credits

- Go Green at Home

- Open a SEP or SIMPLE IRA

- Contribute to an ESA or 529 Plan

- Complete a Roth Conversion

- File on Time or Apply for an Extension

1. Increase Your Contribution Levels

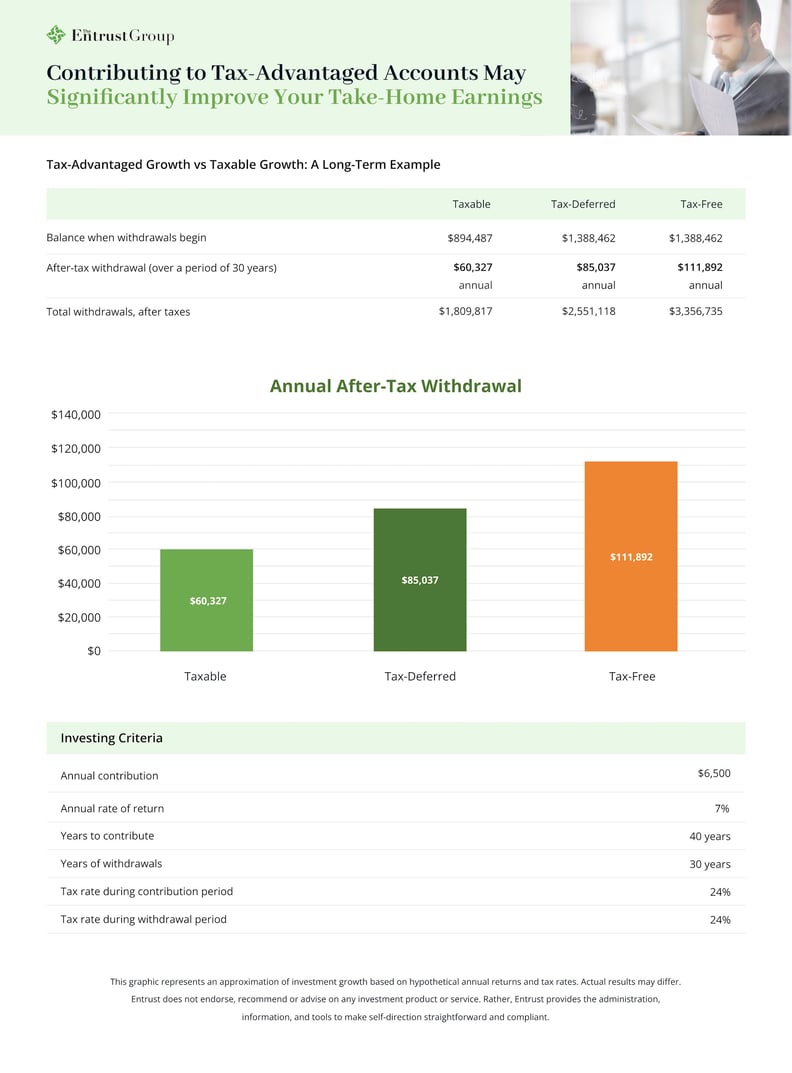

Boosting your contributions to retirement accounts is a strategic way to reduce your taxable income. Depending on your income level, contributions to a traditional IRA can be tax-deductible.

Contributing to an employer-sponsored plan like a 401(k), 403(b), SEP IRA, or SIMPLE IRA can also substantially reduce your taxable income. Funneling more of your income to these plans can also mean benefiting from an employer match, free money towards your retirement savings.

2. Maximize Your Catch-Up Contributions

If you're 50 years or older, you have the option to make additional "catch-up" contributions to your retirement accounts.

For the 2025 tax year, this includes an extra $7,500 for 401(k) or 403(b) plans, an additional $1,000 for traditional or Roth IRAs, and $3,500 for SIMPLE IRAs. These catch-up contributions can significantly bolster your retirement savings, and they are tax-deductible, helping to reduce your taxable income further.

Due to the SECURE Act. 2.0, those aged 60-63 can shelter even more of their income from taxes. For 401(k) plans, these individuals will be able to contribute up to $11,250 above the standard contribution limit. For SIMPLE IRAs, they can contribute up to $5,250 above the standard limit.

3. Aim for Long-Term Capital Gains

One of the primary advantages of waiting for at least a year before selling an asset is that it qualifies for long-term capital gains tax treatment. In most tax jurisdictions, long-term capital gains are subject to a lower tax rate compared to short-term capital gains.

For example, in the United States, short-term capital gains are typically taxed at ordinary income tax rates, which can be considerably higher than the long-term capital gains rate. By waiting for the long-term classification, you may save a significant portion of your profits.

Let's say you invested in a stock and it has appreciated substantially in value. If you sell it after holding it for less than a year, you will be subject to ordinary income tax rates. However, if you hold it for more than a year, upon selling you will qualify for a long-term federal capital gains tax rate of 20%, 15%, or even 0% if you're in a lower income bracket.

It's essential to be aware of your state's capital gains tax rates as well, as these can make a significant impact on your take-home earnings. For example, in California, all capital gains are treated as ordinary income, regardless of how long you've held the asset. This means that even if you've held an investment for many years, the gains can still be subject to state tax rates, which can range as high as 13.3%.

The difference between long-term and short-capital gains is generally only applicable to investments held outside of retirement accounts. If you hold your assets long-term within a tax-preferred account like a Roth IRA, you may not have to pay a dime in capital gains tax.

4. Adjust Your Withholding

A major tax refund might seem like a windfall, but in fact, it’s proof that you provided an interest-free loan to the government.

Fine-tuning your paycheck withholdings is a savvy financial move that can positively impact your cash flow and overall tax situation. To adjust your withholdings, start by assessing your current financial situation. Have there been significant changes in your life since you last filled out your W-4? Changes like marriage, divorce, having a child, or buying a home can all impact your tax liability.

The IRS provides an online withholding calculator that can help you determine the right number of allowances to claim on your W-4. The calculator takes into account factors like your income, marital status, and expected deductions and credits.

To adjust your withholdings, submit an updated Form W-4 to your employer. You can do this at any time during the year, not just when you start a new job. If you've experienced significant life changes or financial changes during the year, it may be wise to revisit your W-4 to ensure it aligns with your current circumstances.

5. Take Business Expense Deductions

If you’re self-employed, leveraging business expense deductions can be a smart financial move.

These deductions can significantly reduce your taxable income, making them invaluable at tax time. The range of deductible expenses is extensive, and some of the most common deductions include:

Home Office Deductions: If you use a portion of your home exclusively for your business, you likely qualify for a home office deduction.

Office Supplies and Materials Deductions: Keep track of expenses related to office supplies and materials used for your business. These are deductible, provided you retain receipts.

Phone and Internet Bill Deductions: Regular phone and internet bills for business use can also be deducted.

Travel Expenses Deductions: When traveling for business, expenses such as flight tickets, bus and train fares, taxi rides, lodging, and some meals are eligible for deductions.

Mileage Deductions: Every mile driven for business purposes can be deducted. In 2025, the mileage rate is 70 cents per mile.

6. Make Charitable Contributions

Support causes you care about while lowering your tax bill.

When you make a charitable contribution to a qualified organization, you can itemize this donation on your tax return. Itemizing allows you to deduct the amount of the donation from your taxable income. For instance, if you're in a 24% tax bracket and donate $1,000, this could reduce your tax bill by $240.

Since charitable donations are part of itemized deductions, they reduce your adjusted gross income (AGI). A lower AGI can have several benefits, such as potentially qualifying you for other tax credits and deductions that have AGI limits.

In order to receive these tax benefits, you'll need to keep proper records of your donations and itemize your deductions.

7. Take Advantage of Qualified Charitable Distributions

A qualified charitable distribution (QCD) provides a way to gain tax benefits from charitable contributions even if you don’t itemize deductions.

QCDs allow you to reduce your taxable income (up to $108,000 for 2025) by directing your required minimum distribution from a traditional IRA or 401(k) to a qualified charity. This can provide significant tax benefits, especially for retirees who want to support charitable causes while minimizing their tax liability.

To make a QCD, you must be at least 70½ years old. The funds must go directly from the IRA to the charity, and it should be to a charity that qualifies under IRS rules (generally, this excludes donor-advised funds and private foundations).

8. Open a Self-Directed IRA

If you’re considering investing in real estate, private equity, or precious metals, you may be able to lower your tax liability with a self-directed IRA (SDIRA).

These powerful investment accounts allow you to invest in alternative assets with the potential for tax-deferred (in a traditional SDIRA) or tax-free (in a Roth SDIRA) growth. This means that any gains from your investments, such as rental income from real estate or returns from private equity, may not be taxed as long as they remain within the IRA. Down the line, this can lead to thousands of dollars in savings.

That said, SDIRAs aren’t for everyone.

While these accounts offer significant opportunities for tax savings, they also come with specific rules and potential complexities. This includes avoiding restricted investments and transactions with disqualified persons.

Wondering if an SDIRA is right for you? Talk to one of our SDIRA experts. Our dedicated team will be able to provide personalized insights and assistance for your unique situation.

Or, if you’re interested in learning more about self-directed investing, including specific examples of what you can and cannot invest in with an SDIRA, download our SDIRA Basics Guide.

9. Health Savings Account

As the cost of healthcare rises exponentially, so too do the benefits of Health Savings Accounts (HSAs).

HSAs offer a unique triple tax advantage, making them one of the most tax-efficient retirement accounts available.

- Reduces Taxable Income: Any funds you contribute to your HSA are tax-deductible, reducing your taxable income for the year.

- Tax-Free Growth: Any interest, dividends, or capital gains earned on the funds within your HSA are not subject to federal income tax. This allows your HSA balance to grow over time without incurring additional tax liabilities.

- Tax-Free Withdrawals: When you use the funds from your HSA for qualified medical expenses, those withdrawals are tax-free.

Plus, HSAs are not use-it-or-lose-it accounts. Funds rollover from year to year. This flexibility allows you to accumulate savings over time, which can be particularly valuable for future healthcare expenses, including those in retirement.

To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). HDHPs generally have lower premiums but require you to pay more out-of-pocket expenses before insurance coverage kicks in.

10. Flexible Spending Account (FSA)

Flexible Spending Accounts (FSAs) are valuable tools for individuals looking to manage specific expenses while simultaneously reducing taxable income.

An FSA allows you to set aside a portion of your pre-tax income to cover certain eligible expenses. These expenses typically include childcare, elder care, medical costs, and prescription medications. By using pre-tax dollars, you effectively reduce your taxable income for the year, resulting in potential tax savings.

You decide how much money to contribute to your FSA at the beginning of the plan year, and this amount is deducted from your paycheck in equal installments throughout the year. This means you have a predictable, tax-advantaged way to cover these expenses.

Note: Unlike an HSA, FSA funds are "use-it-or-lose-it". Any funds left over at the end of the plan year typically do not roll over to the next year and are forfeited. So, it's crucial to estimate your eligible expenses accurately to avoid losing unspent funds.

In general, you cannot have both an HSA and a traditional FSA simultaneously. However, there are exceptions, such as a Limited-Purpose FSA, which is designed to cover specific dental and vision expenses in conjunction with an HSA. Check with your plan administrator.

11. Claim Tax Credits

Ask any accountant: tax credits are the crown jewel of tax planning.

Unlike a deduction, which simply reduces your taxable income, a tax credit directly reduces your tax bill on a dollar-for-dollar basis. For instance, if your tax bill is $10,000, but you qualify and file for $6,000 worth of tax credits, your ultimate tax liability will only be $4,000.

Both the federal and state governments offer tax credits as incentives for specific actions or to alleviate certain expenses. Here are a few of the most commonly claimed tax credits:

Child Tax Credit (CTC): The Child Tax Credit provides a credit for each qualifying child under the age of 17. For tax year 2025, the maximum credit is $2,200 per child, phasing out at higher income levels. This credit is partially refundable, meaning that if it exceeds your tax liability, you may receive a refund for the remaining amount. To claim the child tax credit, you will need to file Form 1040 and fill out Schedule 8812.

Earned Income Tax Credit (EITC): The Earned Income Tax Credit is designed to assist low-to-moderate-income individuals and families. For tax year 2025, the maximum credit ranges from $649 to $8,046, depending on your income level, marital status, and the number of children in your household.

Education-Related Credits: There are several education-related tax credits that can help reduce the cost of higher education:

- American Opportunity Credit: This credit provides up to $2,500 per eligible student for qualified education expenses during the first four years of higher education. It's available for undergraduate students pursuing a degree or recognized credential.

- Lifetime Learning Credit: The Lifetime Learning Credit offers a credit of up to $2,000 per tax return for qualified education expenses incurred at an eligible educational institution. This credit can be used for undergraduate, graduate, or professional degree courses.

- Educator Expense Deduction: While not a tax credit, educators can deduct up to $300 of unreimbursed expenses for books, supplies, and other classroom materials.

12. Go Green at Home

Reduce your carbon footprint to reduce your tax bill.

The Inflation Reduction Act of 2022 expanded the tax credits on offer for making energy-efficient improvements to your home. Homeowners can claim two main types of credits - the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit.

These credits are available to homeowners improving their primary residences. You can also qualify if you rent or use a second home as a residence, but landlords cannot.

The Energy Efficient Home Improvement Credit offers up to $3,200 for qualified improvements made after January 1, 2023. This includes 30% of expenses on items like energy-efficient doors, windows, insulation, and specific heating and cooling systems. However, there are set caps on various items (e.g., $600 for windows, and $1,200 for energy property costs).

The Residential Clean Energy Credit covers 30% of the costs for installing clean energy equipment in your home, such as solar panels, wind turbines, and geothermal heat pumps. There is no annual or lifetime dollar limit, except for fuel cell property.

Note: Due to the One Big Beautiful Bill Act (OBBBA), these credits are set to expire on December 31, 2025.

To claim either or both of these credits, file IRS Form 5695.

13. Open a SEP or SIMPLE IRA

If you’re one of the 33 million small business owners in the US and you’re not contributing to a SEP or SIMPLE IRA, you’re likely missing out on tax advantages.

These accounts are designed to give many of the benefits of 401(k) plans without the need for complex or costly administration.

A SEP IRA is particularly beneficial for businesses with variable income because it offers flexibility in contributions. You can choose how much to contribute each year (up to a set limit), making it easier to manage in years when cash flow is tight.

SEP IRAs offer much higher contribution limits compared to traditional IRAs. For tax year 2026, SEP IRA contribution limits are the lesser of 25% of compensation or $72,000.

On the other hand, SIMPLE IRAs are designed for businesses with 100 or fewer employees. They are easier to set up and manage than many other retirement plans. Employers can either match employee contributions or make non-elective contributions, regardless of whether the employee contributes.

If you provide contributions to your employees’ SIMPLE IRAs, these contributions are deductible business expenses. This not only aids in reducing your taxable business income but also enhances employee satisfaction and retention.

Plus, the IRS offers a tax credit to offset the costs of establishing these plans. This credit can be as much as 50% of the cost to set up and administer the plan, up to $500 per year, for the first three years of the plan.

14. Contribute to an ESA or 529 Plan

Contributing to an Education Savings Account (ESA) or a 529 plan can offer tax benefits, although they don't directly lower your taxable income in the way that deductions do.

The primary benefit of both ESA and 529 plans is that the earnings grow tax-free. This means that while the contributions are made with after-tax dollars, any interest, dividends, or capital gains generated within these accounts are not subject to federal (and often state) taxes when used for qualified educational expenses.

This can significantly lower the overall cost of education since the earnings portion of the withdrawals is not taxed.

However, many states offer state income tax deductions or credits for contributions made to a 529 plan. These state tax benefits can effectively lower your state tax bill. However, the specifics vary by state, and not all states offer these incentives. ESAs do not typically offer state tax benefits.

15. Complete a Roth Conversion

Alright, this one’s a bit of a stretch, as it actually increases your tax bill in the short term. However, if you expect to be in a higher tax bracket in the future, a Roth conversion could end up lowering your overall tax bill down the line.

By moving funds from a traditional IRA into a Roth IRA, you're essentially locking in your current tax rate, paying taxes on that money today to enjoy tax-free withdrawals in retirement. This strategy can be particularly advantageous if you expect your income tax rate to be higher in retirement.

Plus, unlike traditional retirement accounts, Roth IRAs do not have RMDs. This means you can leave your funds to grow tax-free for as long as you like, allowing for more flexible retirement planning.

16. File on Time or Apply for an Extension

Last but not least, one of the simplest, most effective ways to reduce your tax bill is filing on time.

About 5% of filers receive an extension until October 15, though approximately 10% of people don’t file at all. This translates to millions of Americans failing to meet their tax obligations.

The consequences of late or non-filing can quickly stack up to a hefty bill:

Late Filing Penalty: If taxes are owed and the return is filed late, the IRS imposes a late filing penalty. This is typically 5% of the unpaid taxes for each month or part of a month that a tax return is late, not exceeding 25% of your unpaid taxes.

Interest: Additionally, interest is charged on any unpaid tax from the due date of the return until the payment date. The interest rate is determined by the IRS and can change quarterly.

Compounded Debt: Over time, the combination of penalties and interest can significantly increase the amount owed, making it more challenging to clear the tax debt.

If you anticipate difficulty in meeting the tax deadline or paying your taxes, the IRS offers options like filing for an extension or setting up a payment plan to help manage tax liabilities more effectively.

Take Advantage of Tax-Advantaged Growth

Tax planning is anything but a once-a-year event. It’s an ongoing opportunity to enhance your financial well-being.

The strategies we've outlined in this article aren't theoretical; they can yield tangible benefits when applied with care and consideration. Implementing even a few of these strategies can make a noticeable difference in your ultimate tax bill.

Of course, the world of tax-advantaged growth is ever-evolving, and staying informed is key. By subscribing to our monthly newsletter, you'll gain access to a wealth of knowledge that goes beyond tax season. We’ll send you timely updates, practical advice, and expert insights to keep you ahead of the curve.

After you’ve signed up, browse the resources in our Learning Center. From in-depth blog posts and comprehensive guides to informative webinars, we cover a wide range of topics to cater to both budding enthusiasts and seasoned investors.

Got another tax-saving strategy to add to the list? Let us know in the comments below.

0 Comment