IRA Transfer vs. Rollover: What's the Difference?

Estimated reading time: 10 minutes

Understanding the difference between a transfer vs rollover is crucial to effectively manage your retirement savings. These strategies differ in their handling of funds, reporting requirements, and tax implications. Gaining a comprehensive understanding of these differences and consulting with a financial advisor can empower you to make well-informed decisions with your retirement savings.

Table of Contents

- What about Contributions?

- Rollover Rules to Keep in Mind

- What About Contributions?

- Transfers vs. Rollovers FAQs

- Fund your SDIRA at Entrust

What's the Difference Between an IRA Transfer and Rollover?

The difference between a transfer and a rollover is that IRA transfers are used to move funds between the same account type, while rollovers are used to move funds from one type of account to another.

For instance, if you want to move funds from your traditional IRA to a traditional IRA at another institution like Entrust, you would initiate a transfer. If you’d like to move the funds in a former employer’s 401(k) plan to a traditional IRA, you would initiate a rollover with your previous employer.

What is a Transfer?

Simply put, a transfer moves an existing retirement account to a new financial institution. The account type does not change. This is sometimes referred to as a trustee-to-trustee transfer.

For example, you can easily transfer your assets in a Roth IRA from one institution to a Roth IRA held at another. As far as the funds are concerned, the only fact that’s changed is the financial institution.

When using a transfer, the funds in the IRA are never made payable or distributed to the account holder - they travel directly from one institution to another. This means the assets are not taxable, and the transfer is not reported to the IRS.

The transfer rule applies to all types of retirement accounts, including SEP IRAs and SIMPLE IRAs. The account type must remain the same, barring one exception — a SIMPLE IRA may be transferred to a traditional IRA once two years have elapsed since the first contribution.

Have questions about Entrust? Book a free consult >

What is a Rollover?

Another way to move funds into your SDIRA is a rollover. Rollovers are used to move funds from one type of account to another.

For instance, if you wanted to move funds from a 401(k) to a traditional IRA, you would initiate a rollover. There are two types of rollovers, and they each have distinct tax implications. However, all rollovers must be reported to the IRS.

Direct Rollover

A direct rollover is a simple way to move funds from an employer-sponsored plan such as a 401(k), 403(b), or governmental 457(b) to a new retirement plan or an IRA.

For example, if you decided to move your retirement savings from a previous employer's 403(b) to an IRA, you could initiate a direct rollover. Similar to a transfer, your funds move from institution to institution with a direct rollover.

Indirect Rollover

An indirect rollover, also known as a 60-day rollover, is the process of withdrawing funds from a retirement account, such as an IRA or 401(k), and depositing them into another retirement account within 60 days.

As the name implies, an indirect rollover requires more actions than a direct rollover. Here's a step-by-step guide to the process:

- Request a distribution: To start an indirect rollover, you'll need to request a distribution from your retirement account. You can do this online or by contacting your plan administrator directly.

- Receive the distribution: Once your request is approved, you'll receive a check or direct deposit of the funds into your bank account. It's important to note that the check will be made out to you, not the new retirement account. Distributions from 401(k)s, 403(b)s, and governmental 457(b)s require 20% tax withholding.

- Deposit the funds into a new account: You'll need to deposit the full amount of the distribution, including the withholding, into a new retirement account within 60 days. This ensures that the rollover is complete, allowing your funds to return to their tax-advantaged status.

- Reclaim the withholding: If you deposited the full amount of the distribution into the new account, you may reclaim the withholding when you file your tax return. If you failed to deposit the full amount, any funds not rolled over will be subject to taxes. You may also have to pay a 10% early withdrawal penalty if you're under age 59½.

Rollover Rules to Keep in Mind

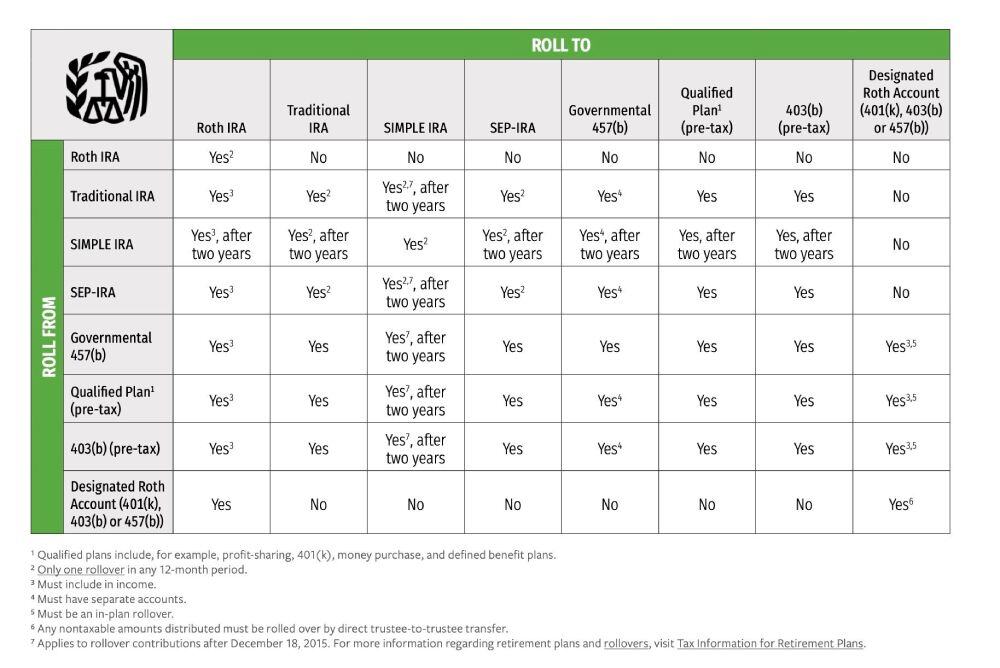

Before you initiate a rollover, there are a few other rules to keep in mind.- The IRS has a one-rollover-per-year rule when rolling over funds between two IRAs. This rule applies to traditional, Roth, SEP, and SIMPLE IRAs. As an example, if you take a 60-day distribution from your traditional IRA and rolled it over to a Roth IRA, you may not take another rollover distribution from any IRA within a 12-month period. This rule, however, does not apply to direct transfers or direct rollovers.

- You cannot roll over a required minimum distribution (RMD) from your IRA.

- Most employer plans require that you are no longer a current employee to remove funds from your retirement plan. If you are still working and would like to take a distribution from your employer’s 401(k) plans check with your employer to see if they allow in-service withdrawals. If so, and if there are no restrictions on the plan’s in-service provision, you may be able to complete a direct rollover.

What about Contributions?

Transfers and rollovers are the two most popular SDIRA funding methods, but they’re not the only strategies investors take advantage of. You can also grow your account by making yearly contributions.

Contributions can be made via check, wire transfer, or electronic funds transfer (EFT). Make sure to review the current contribution limits if you’re considering this method. The IRS updates the limits each year.

If you’re 50 years or older, check out the updated catch-up contribution limits. You may be able to devote an even larger percentage of your funds to tax-advantaged growth.

IRA Rollover vs Transfer FAQs

1. What is the difference between a transfer and a rollover?

A transfer is used to move funds from one institution to another without changing the account type. A direct rollover is used to move funds from an employer plan to another account type like an IRA, without having to pay taxes. An indirect rollover entails taking a short-term distribution to move funds from one account type to another. If the funds are not deposited within 60 days, the funds may lose their tax-advantaged status.

Each funding option has different tax implications if not done correctly, so be sure to consult with a financial advisor or tax professional.

2. When should I use a transfer versus a rollover?

Only you can answer that question. Your decision will depend on factors such as your current plan, the account you want to open, and your intended use of the funds.

If you have a traditional IRA and are satisfied with your current growth strategy, a transfer may be your best option. However, if you have funds in an old employer-sponsored retirement plan that you’d like to place in a self-directed IRA, a rollover could be exactly what you’re looking for.

Ultimately, the choice between a transfer and a rollover depends on your investing strategy and how quickly you need to fund your investment options. Consult with a trusted financial advisor to ensure you have the information you need to make a final determination.

3. What is a Roth conversion? Is that the same as a backdoor Roth?

A Roth conversion and a “backdoor” Roth are similar, but not quite the same.

A Roth conversion is a rollover of assets from a traditional IRA or a qualified retirement plan, such as a 401(k), into a Roth IRA. You will owe income tax on the amount converted in the year of the switch. If you’re under 59½, the early distribution penalty is waived. Future earnings distributions from the Roth IRA will be tax-free if certain conditions are met.

A "backdoor Roth IRA" is a conversion strategy that enables individuals with high incomes to contribute to a Roth IRA, bypassing IRS income limits. Essentially, it involves placing post-tax funds into a traditional IRA and subsequently converting those funds into a Roth IRA. This approach allows anyone to access the benefits of a Roth IRA, regardless of their income eligibility.

If you’re unsure if this strategy is right for you, contact a tax professional or advisor.

4. What is a rollover IRA? Is that a different kind of IRA?

A rollover IRA is not a special kind of IRA. Some firms use the term to refer to an IRA funded via a rollover from a previous employer. For instance, if you rolled over funds from a 401(k) or other retirement plan into an IRA, you would have a rollover IRA.

5. Is IRA to IRA a transfer?

As long as the process involves moving funds from the same type of IRA between institutions, then it is a transfer. For example, moving funds from one Roth IRA to another Roth IRA is a transfer. However, moving funds from a traditional IRA to a Roth IRA would require a conversion.

6. Are there limits on IRA transfers?

There are no limits on the number of transfers you can conduct in a given year, nor is there a limit on the amount you can transfer.

7. How often can you complete a rollover?

You may only complete one rollover in a 12-month period.

The one-rollover-per-year rule applies to individuals, not to IRAs. For instance, if you have multiple IRAs, you may only roll over one account in a 12-month period.

This limit generally does not apply to transfers, Roth conversions, or direct rollovers. The funds are never made accessible to the account holder, so these are considered non-taxable events. However, if you’re interested in making more than one transfer, conversion, or direct rollover per year, consult with a tax advisor or financial professional to ensure your funds are in the clear.

8. How do I report a rollover?

There are two essential elements of an indirect rollover: distribution and contribution. The distribution occurs when the funds are initially withdrawn. The contribution occurs when the funds are rolled into the new account.

As the receiving institution, Entrust reports the rollover on IRS Form 5498. The distributing financial organization reports the distribution on IRS Form 1099-R.

You will report the distribution on line 4a of your IRS Form 1040. If you roll over the full amount, you should also write the word “rollover” on line 4b of Form 1040.

Fund Your Account at Entrust

And there you have it. Funding your SDIRA is as easy as transferring, rolling over, or making a contribution. If you want to learn more about different ways to fund your new self-directed account, download our Funding Guide.

Don’t have an account yet? We make it easy to open an SDIRA in about 10 minutes, and the Entrust Client Portal makes managing your account a breeze.

As always, it’s a good idea to discuss any investments and changes to your retirement strategies with a qualified financial expert.

0 Comment