What You Need to Know About Investing in Precious Metals

Estimated reading time: 6 minutes

For many investors, their ideal portfolio is one that offers steady growth and a sense of stability during an economic downturn. That’s why so many prioritize portfolio diversification, one of the most effective (though not foolproof) ways to reduce overall risk.

When considering options to increase diversification, few assets shine as brightly as precious metals. Gold and silver have long been viewed as hedges against inflation and market downturns. Meanwhile, metals such as platinum and palladium have experienced tremendous growth due to their vital and varied industrial applications.

In order to invest in precious metals with confidence, you must understand the unique attributes of each metal. In this blog post, we'll guide you through the four precious metal investments allowed in an IRA and highlight why this asset class can be a valuable addition to your retirement portfolio.

4 Types of Precious Metals to Explore

If you want to invest in precious metals, you have four primary options to consider.

1. Gold

Historically, investors have revered gold as the ultimate store of value. Its timeless allure is deeply ingrained in human culture and economics. Over the years, gold prices have often spiked while other assets faltered or plummeted during times of economic uncertainty.

The world’s gold supply is relatively stable with a modest increase in production with each passing year. Over 40% of all gold mined originates from the Witwatersrand Basin mine in South Africa. Demand for gold is driven not only by investment but also by the jewelry industry, central bank purchases, and new technologies in dentistry, electronics, and even space exploration.

2. Silver

Silver is often referred to as "the poor man's gold," but it boasts its own unique investment qualities. Silver exhibits dual purposes, serving both as an investment and industrial metal. Its price dynamics can be more volatile than gold, offering investors the potential for a higher rate of return.

The demand for silver is influenced not only by its popularity as an investment but also by industries like electronics, solar power, biotechnology, and healthcare. This metal boasts unparalleled optical reflectivity and high levels of thermal and electrical conductivity. Leveraging these exceptional properties, silver has carved a prominent niche within industrial applications such as electronics, solar power, biotech, and healthcare.

Today, the majority of the world’s silver is mined in Mexico, China, and Peru.

3. Platinum

Platinum stands out as an industrial powerhouse among precious metals. While it's considered a store of value, it's in high demand in the automotive and tech industries. A critical component in catalytic converters for vehicles, this industrial demand significantly influences its price trends.

Platinum's supply is limited, with the vast majority originating in South Africa. Demand is driven mainly by the automotive sector and, to some extent, fashion, as it is a popular choice for fine jewelry. Platinum's exceptional properties help reduce emissions in vehicles, positioning it at the forefront of green technologies.

4. Palladium

Palladium shares similarities with platinum but has recently garnered significant attention, especially in the automotive and green industries. Sourced primarily from South Africa, palladium’s use in catalytic converters has resulted in impressive price growth over recent years.

Its unique supply-demand dynamics have captivated the minds of many market enthusiasts as emission standards become more and more stringent worldwide. This focus on reducing harmful pollutants could potentially lead to greater demand, and therefore greater market value.

Consider an SDIRA For Precious Metals Investing

Nearly anyone can invest in precious metals, but there's a catch – the typical IRA offered by a bank or brokerage often doesn't include precious metals in their list of investment options. Instead, you're limited to stocks, bonds, and mutual funds.

That’s where a self-directed IRA (IRA) comes into the picture. This powerful investment vehicle allows you to invest your tax-preferred retirement funds into dozens of different alternative assets, including precious metals. Not only does this offer the potential for substantial returns, but it can also significantly reduce your tax liability.

With a traditional SDIRA, your contributions may be tax-deductible, and your investments grow tax-deferred until you make withdrawals. If you invest with a Roth SDIRA, qualified withdrawals may be distributed tax-free. This can be particularly advantageous if you anticipate higher tax rates in retirement.

Further, many SDIRA holders value precious metals as uniquely well-suited for a retirement fund portfolio. Your retirement portfolio is meant to provide a steady stream of income in the years after you’ve left the workforce. So, investors are often more conservative with these funds, especially as they approach retirement age.

However, many IRA and 401(k) providers don’t have the infrastructure to facilitate transactions with alternative assets. This limits your investment options to stocks, bonds, and mutual funds.

That’s where we come in. As a leading SDIRA administrator, we have the bandwidth and expertise to facilitate transactions of countless alternative assets with your retirement funds.

So, you’re able to access new counter-cyclical opportunities with your retirement funds, such as precious metals. This diversification can help reduce overall portfolio risk and increase the odds of steady distributions, especially during periods of market volatility.

Study Up on the IRS Rules Before Investing

It's important to note that while SDIRAs offer numerous benefits, they also come with specific rules and regulations that must be followed to maintain their tax-advantaged status.

For instance, if you ever take physical possession of the metals, your account may lose its tax-advantaged status. That’s why it’s vital that you transact with a trusted precious metals dealer and depository to purchase and store your precious metals assets.

Additionally, any metals held in an SDIRA must meet purity requirements and be struck by an approved Assayer, Refiner, or Mint as specified by the Internal Revenue Code. Otherwise, you risk disqualifying the tax-advantaged status of all assets held in the account.

Read up on the IRS rules and work closely with a reputable SDIRA custodian to ensure compliance. That way, you can make the most of the benefits offered by this flexible investment vehicle.

Ready to learn the ropes? Dive into our SDIRA Rules Guide

How to Invest in Precious Metals with Your Retirement Funds

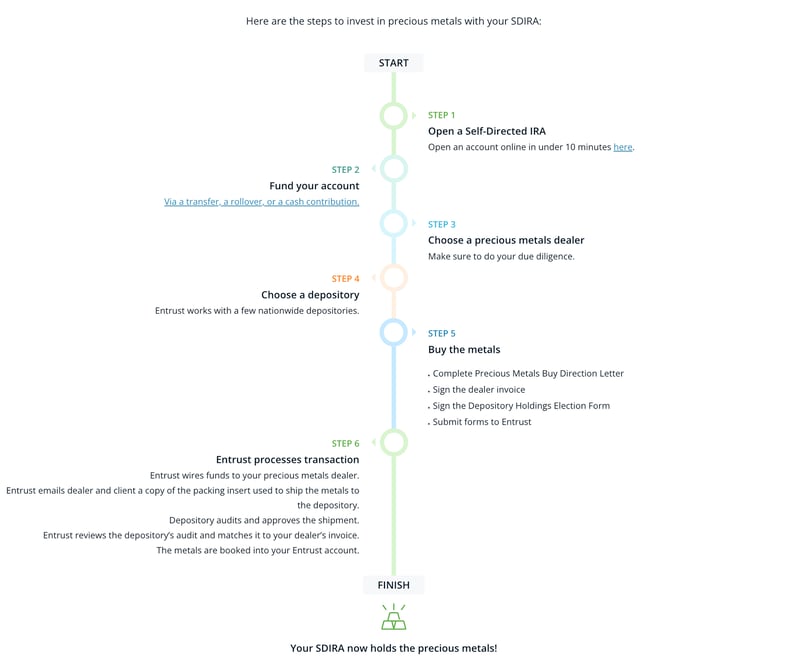

Once you’ve assembled your precious metals team (dealer, depository, SDIRA custodian), it’s time to purchase your precious metals. The investment process may take a few weeks from start to finish.

Here’s what the process looks like when you choose Entrust as your SDIRA administrator:

- Open your Precious Metals IRA in less than 10 minutes. Note: You cannot move physical metals that you already own into the account. However, if you already own precious metals in another SDIRA, you can transfer those metals to your new SDIRA at Entrust.

- You can also fund your account via a direct rollover from an account you have through a previous employer’s retirement plan such as a 401(k), 403(b), or governmental 457(b) plan.

- Direct your SDIRA custodian to purchase the assets from a trusted dealer. Choose a reliable depository to hold your SDIRA’s new precious metals.

- Once the purchase is made, the dealer will send the metals to the depository.

- The depository will verify that the metals received match the invoice.

- The depository will then email Entrust confirmation of the delivery, reporting the type and quantity of metal received.

- Entrust will enter the information into your account. If any discrepancies are found, our team works directly with the depository and dealer to resolve them.

That’s all there is to it.

After successfully investing in precious metals with your SDIRA, effortlessly track your account’s performance through the Entrust Client Portal. For ultimate convenience, download the Entrust mobile app, ensuring your portfolio is never more than a tap away.

Mine the Possibilities of a Precious Metals IRA

The world of precious metals is rich and varied. Each metal offers unique investment attributes and industrial applications.

If you open an SDIRA, you’ll gain the flexibility to add counter-cyclical assets like precious metals to your retirement portfolio. This can help reduce overall risk and enhance stability, even in turbulent economic periods.

Before you invest in precious metals with your retirement funds, it's essential to familiarize yourself with the IRS rules and guidelines. Compliance is crucial for maintaining the tax-advantaged status of all assets held in your retirement account.

Finally, remember to conduct thorough due diligence. Leave no stone unturned in your search to find a reputable SDIRA custodian, precious metals dealer, and precious metals depository. Assembling a team you can trust may take time. Don’t rush the process.

If you’re ready to add precious metals to your portfolio, talk with one of our IRA experts today. Or, if you’d prefer to keep learning, download our Precious Metals IRA Guide. Inside, we’ve included a detailed breakdown of the qualities to look for in an SDIRA administrator, as well as three crucial tips for conducting due diligence on precious metals dealers.

.png?width=700&height=769&name=Precious-Metals-IRA-Guide-ebook-cover%20(1).png)

1 Comment